Everyday, I strike different conversations with my new blog followers.

Their messages come in all forms of communications methods. Through emails, where they can write a little longer and share with me more of their requirements. Whatsapp is usually the most common communication method. Right after reading my articles, they want to clarify with me certain issues they resonate with and are currently facing.

Just last weekend, I met up with a friend and avid follower of my blog articles. She lives with 2 children at Waterway Terrace, and this HDB cluster will be due for MOP soon. As usual, home owners get excited just slightly before MOP, that’s because it’s time to upgrade their property!

Thus, I will be sharing with you some of the regular issues that we had during our catch up session and also from others that I come to hear of repeatedly. With that, I would love to use more data and statistics to influence the way you perceive about your current property situation.

Screenshot from HDB website > HDB History and Towns > HDB Towns, Your Home > Punggol

1. I Can Sell Higher After Everyone Sells Their Flat

This is the most common remark I get these days mainly due to the influx supply of newly MOP flats. This additional supply was a result due to a measure ordered by Minister Khaw in 2011. He wanted HDB to ramp up the supply of new BTO HDB flats when he was in Ministry of National Development.

Minister Khaw ordered HDB to ramp up supply in 2011

Is there then, a historical trend where we can get a rough sense of how prices of HDB flats move right after MOP? The best reference I can think of would be Pinnacle @ Duxton. Located in the heart of Singapore, with no lack of amenities and public transport, this project will be an ideal comparison as it makes a best benchmark for HDB Flats in Singapore.

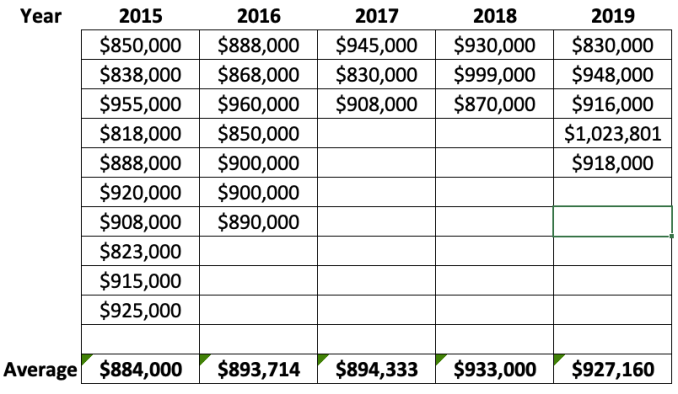

Transactions at Pinnacle @ Duxton

After compiling and finding the averages of the sale prices for 4 bedroom units between 2015 to 2019, it seemed like the increase over a 5 year period was only 5% gains. That translates to an annualization of 1% per annum.

Averages That I Compiled Myself

Take note, over this similar period, there are numerous private properties that annualized at 4.4% to 8% over a 4 year period.

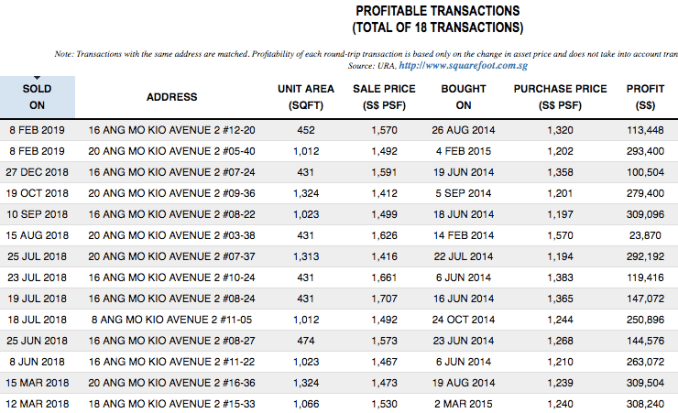

Profitable transactions in a 4 year period at Panorama, Ang Mo Kio

Meaning to say if an owner is still holding on to his Pinnacle @ Duxton HDB Flat today, his total gains would look like this in 2019

Pinnacle owner holding on till 2019

Value in 2015: $800,000

Value in 2019: $840,000

Total extra gains over next 5 years: $40,000

However, if he made some calculated moves in 2015 and decided to restructure his portfolio to a private property, his gains would look like this:

Pinnacle owner switching to private in 2015, and sold private in 2019

Value of private property in 2015: $950,000

Value of private property in 2019: $1,276,000

Total extra gains over 5 years: $326,000

High capital gains at North Park Residences in 4 year period.

The HDB owner who thought he might stand to gain more by holding his position collected $286,000 lesser in profits compared to the owner who decided to increase his wealth by understanding data and figures.

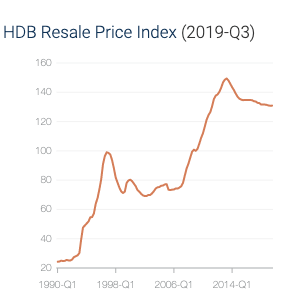

I managed to use this reference after meeting a blog follower who currently lives at Waterway Terrace in Punggol. I shared with them this simple analogy. If Pinnacle @ Duxton, being situated in central Singapore, only gained 5% over 5 years immediately after its MOP, will Waterway Terrace fare better or worse?

Well, only time can tell 5 years later, but we don’t wish to lose our prime time to invest in this manner, right? My experience tells me that prices for Waterway Terrace will be stabilised with not too huge a price movement.

When the capital of your property doesn’t inch upwards over a period of a few years, it doesn’t signify that property prices are flat across the board. By spotting the right property to own, you can still make gains out of it.

Moreover, the best time to achieve the best price for any newly MOP flat is always at the 5 year mark. Think about it this way, the next buyer of yours already knows that the renovation is the freshest they can get. Your corridor, void decks and car parks do not look dated, old or aged. That is when buyers will pay the best price for it. So why not, just let go and move on and upgrade to your next portfolio.

At this juncture, my friend totally agrees that the best time to sell the flat is at the 5 year mark. Then she threw me another bomb.

2. My HDB Will Appreciate Further After Punggol Coast MRT Is Completed

“There are so many upcoming developments in the next few years in Punggol. These will impact my prices and it will go up for sure!”

I thought to myself. That sounds like a logical reasoning. New shopping malls or even new MRT stations should push prices up, right?

Not exactly.

A Treasure Trove is a private condominium that was launched in 2011 through Developer sales. Upon its completion in 2015, owners started putting up units for sale in the resale market.

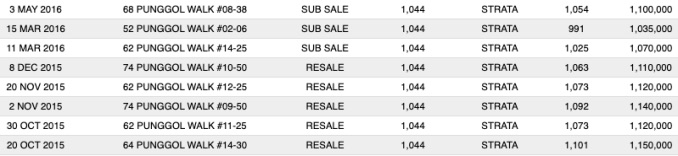

A Treasure Trove (Before/After) Waterway Point Was Completed

At that time, Waterway Point was officially opened on 19 April 2016. Now I would be compiling data on transactions which happened before and after from Waterway Point’s opening. This was what I found out.

Before the mall was completed:

Average $1090.2psf over 10 transactions between 7 Oct 2015 to 15 Mar 2016

After the mall was completed:

Average $1042.7psf over 10 transactions between 3 May 2016 to 4 Apr 2017

1 year after mall was completed and more enhancements in Punggol Town:

Average $1042psf over 10 transactions between 29 May 2017 to 25 Apr 2018

Wah! In fact, the average prices dropped after newer amenities were completed. My friend couldn’t believe it as well. But a fact is a fact, we cannot dispute over facts. Thus, a word of caution. For those waiting for Sengkang Grand Mall to be ready 4 years later in hope that your resale prices will inch up, just be aware of similar past trends.

I’m not saying prices won’t move, since if overall market moves up, you definitely will have made gains on it. But, it’s a matter of whether your gains are 1% per annum or you prefer a 4% per annum.

By understanding data correctly, we can optimise our gains strategically.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

3. Oversupply, Oversupply, Oversupply!

This story is always retold and I have heard this statement multiple times. After HDB owners sell at a handsome profit, they encounter this fear of re-entering the property market. Especially when they are now upgrading to a bigger ticket item. Why so? They hear their friends say “Too much supply in the market, we wait for prices to drop.”

Even Straits Times will inform us to be cautious since there seems to be too much supply in the market. Or “Move back to parents house first, we try to time the market.”

All these are valid concerns, we all have a fear of the unknowns. Especially when we do not crunch the property figures daily and don’t have a sense of the market. Let me breakdown some facts and you decide for yourself, what will the supply market be like 3-4 years later.

Any new launch inventory is driven mainly by 2 sources: En-bloc land and Government Land Sales (GLS). However, take note that throughout the entire 2019, only 1 en-bloc deal went through. But it was just a 5 unit sale of an entire development to a private buyer, not a Developer.

Besides that, our government reduced the total land parcels for sale to only 6 plots. A land plot will usually be put up for tender after a Developer commits a minimum bid price set by the government. Thus, the new supply added on this year is almost 0.

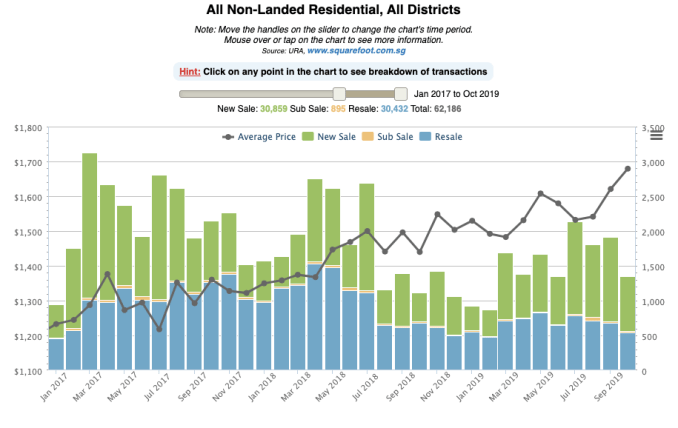

Our total unsold new launches stands at 50,346 units today. Next, we analyse the average new launch sold every year. After the 2013 heavy cooling measure was implemented, market was softer then before.

Between the period of 2013 to 2017’s lifting measures

Average sales per annum: 12,000 units.

Between 2017’s lifting measure to Oct 2019 (1 year after latest cooling measures)

Average sales per annum: 10,000 units.

With these diminishing supply figures and no new incoming supply for the next coming year, we will have an estimate of 20,000 unsold supply by end of 2022.

So…? How does this affect the private property prices?

Now imagine if you are the boss of a big Developer firm. In 2019, you had 1000 units to sell, thus you price it marginally and make lesser profits. You manage to sell 600 units later and have 400 units left to sell over a next period of 2 years. Your average monthly sales is 20 units consistently. Would you then sell the remaining units cheaper or will you increase the prices since you are not in a hurry to sell anymore? Furthermore, your inventory is diminishing month by month.

A simple calculation into Developer’s current unsold inventory and how much sales they move a month will give you a clear answer on whether this Developer will cut its own price later on. Truth to be told, the bigger Developers with popular projects like Parc Esta, Jadescape, Avenue South Residences will be less likely to cut their prices at the end of the line.

And those other projects which registered 30% or lesser sales? They are usually in the core central with a different market segment. Mass market segment in suburban areas will always register healthy sales due to the buyer’s affordability.

4. There Are Not Many BTO Flats In The Market

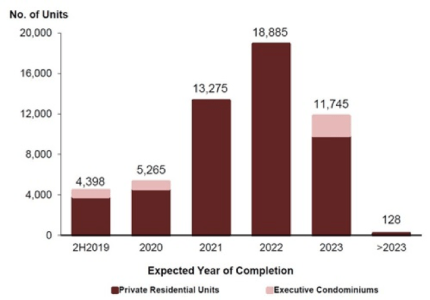

Do you recall the previous ramped up order of BTO HDB Flats in 2011? That would lead to ten thousands of flats ready to be resold at MOP. In fact, 30,000 and onwards.

Having 30,000 home owners who can potentially sell their flat doesn’t signify that everyone will sell it off. But, based on my investigation on the numbers of HDB owners who upgrade to a private property, the annual change in property rate is 1%. We have a total of more than 1 million flats, and that would account for a 10,000 shift in demographics.

Before you think that there will be a rush and influx of demand in the next few years, do not panic. Do not sell your HDB flat at all until you have a plan first.

Do not encash for profits until you are clear on what to buy next, and whether that property can generate more profit returns while you are living in it for a couple of years.

If you are really considering on making the next right move, please let me understand your situation so that I can offer you the right advice. One man’s meat is another’s poison. There is no one size fits all plan.

You might just want to give me a call or WhatsApp at +65 9007 4405 to discuss your objectives, or simply have a second opinion on what could be the best option you. You may want to submit the form below if you prefer a callback.

Since you have made it to the end of this article, I’m guessing you must be someone who is really interested in the property market or is in a similar situation as a HDB upgrader. I love connecting with people of similar interests, so feel free to have a chat with me over your thoughts towards this article (or anything related to property) 😁

Lastly, I recommend going to our YouTube channel next to find out how MDLSG has been helping owners command the selling price they want through the new age method of real estate marketing. 😉.