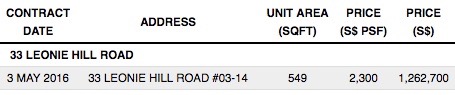

Point in example, OUE Twin Peaks at Leonie Hill Road, relaunched the project at attractive discounted prices in May 2016. One particular studio unit on #03 was sold for $2300psf. This works out to $1,262.700. Nobody was expecting the cheapest unit to be launched at this price, and it is only one ready investor who is prepared to commit the downpayment immediately, can own it.

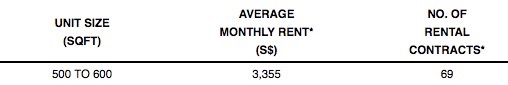

It is a no brainer to commit at this price for a brand new project in prime District 9, just behind Orchard taking into consideration that it is also ready to be rented out almost immediately, which means positive cash flow. Furthermore, the developer dangled carrots for purchases, like providing the apartment fully furnished, and 3 years deferred payment scheme.

But! But the most crucial question to ask yourself at this moment is, when the opportunity arrives, are you ready to purchase it? For most investors, the answer is NO! Why?

These Are Always The similar Obstacles I Encounter When Consulting:

- Buyers have not structured their property ownerships properly, and if they commit to a second purchase, they have to fork out hefty ABSD.

- They own a 50% stake on the first purchase’s loan and they have not sold the stake to their spouse or investing partners. With an existing loan, they can borrow up to 60% of purchase price, which meant a hefty downpayment.

- Their profits from the first property are just a paper gain. They have not exited from the first property in order to cash out the profits, which will be used as downpayment for the second property purchase.

Do you find yourself in pretty similar situations? Early planning made on your portfolio can help you make money when the opportunity arises.

This is what you should do to reduce investment risk and not get caught in any possible forms of scenarios.

- Always plan to commit on the second property without using any extra cash from current savings that you have saved.

- Calculate exactly how much your monthly cost is, adding up these components: Monthly mortgages, maintenance, taxes etc.

- Try to achieve a $0 cash top up monthly.

- Always, always set aside a minimum of 2 years reserve funds set aside.

How do we ensure the calculations are correct? I have a specially programmed calculator for real estate calculations.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.