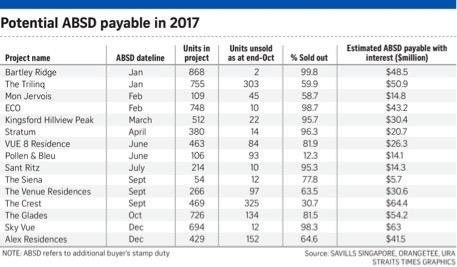

Time is running out for developers who purchased land in 2011 with new government rulings. They only have a five year period to build and fully sell all units by next year, 2017.

What happens if they fail to do so? They will face a 10 percent levy on the site’s purchase price plus 5 percent interest. I am not expecting to see any fire sales coming from the developers themselves. I have come across developers who have holding power, and will only relaunch the projects to sell when market sentiments are better.

If they have more than 60 percent of unit already sold, they can also set up companies to buy over the remaining units.

The new firm will pay ABSD (currently at 15%) for the purchase of the units, and this might be lower than paying ABSD charge and interest for the land purchase price.

Analyzing the above pattern, and how developers will likely react to the looming deadline, I do not expect very drastic cut in their prices, but I am expecting good discounted buying opportunities for investors looking to own a second rental investment.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.