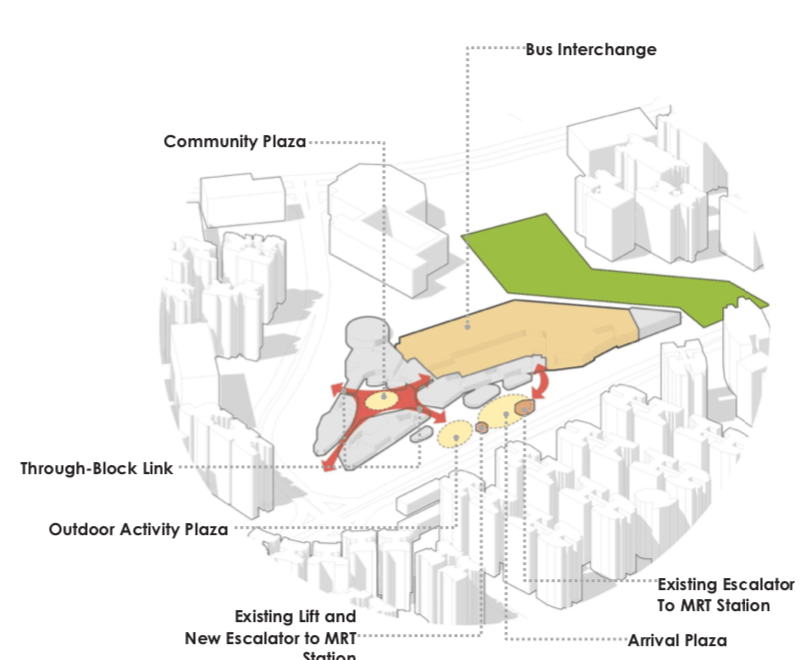

Buangkok residents will be utterly delighted when the new integrated development which integrates a bus interchange, MRT station, retail shops and residential units is completed in 2022.

This 3 storey integrated development with 680 apartments and malls below will also have a community center, childcare centers and hawker centers.

Sengkang Grand Residences Looking Grand Here.

Integrated malls which are developer managed are generally favoured over strata title malls, where the latter has no common tenant management department to pull in the right mix of retail tenants. You feel more assured that the future retail tenants in this mall, which is jointly developed by Capitaland & City Developments will be a crowd drawer with main anchor brands.

Fully integrated amenities and facilities next to Buangkok MRT Station.

Sengkang Grand Residences is the next hot topic, and talk of the town in the Sengkang & Punggol neighbourhood now. You will be surprised to find out that integrated development forms only 3% of total residential units in Singapore.

Since it is a rare commodity, and it is like a one and only, does it mean I am sure to make a profit from it?

Is it worthy of your investment money?

Many of my followers are waiting for this exciting launch. Exciting in the sense that we hardly see this profile of launches in recent years. They are already very hyped up by its offerings and almost seemed prepared to place a cheque on sales day.

However, I told them to hold their horses and think about it logically instead of being emotional about the overall product. Well, the news media and developer advertisements are meant to make you desire for it and purchase it without hesitation.

Let’s examine and analyze the data on Singapore’s popular integrated developments. I can think of 3 popular neighborhood properties. Namely, Watertown in Punggol, North Park Residences in Yishun and Centris in Boon Lay.

- Waterway Point In Punggol

- North Point In Yishun

- Jurong Point In Boon Lay

These 3 properties have common traits like a bus interchange which integrates with the MRT Station. Right below them, are developer managed malls and they all reside within a sub urban district, in neighborhood centers, which is very much similar to Sengkang Grand Residence, thus it makes a good close comparison.

All 3 have their unique good factors that helped investors make profit from it. Let’s look into the profit margin these 3 condos generated.

Average profit across these 3 properties.

North Park Residences: $115,000 over 4 years period.

Centris: $500,000 over 10 years period.

Watertown: $80,000 over 7 years period

Here’s the puzzling part. Punggol has always been a more popular neighborhood to live in compared to Yishun, where North Park Residences is. We can see that Punggol town has more young families, multiple well established malls, child care centers, parks etc. But why was the profit margin for Watertown the lowest, and across a longer investment horizon?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Sales Price = Rentability and Rental Yields

This is always an important rule to look into whenever I decide whether to invest on a property or not. What do I mean?

Strong rental demand and weak supply of residential units will hold up rental prices. Therefore, rental yields will be strong and the rate of unit vacancies is lower. When the rent I collect is high, I can command a higher sales price.

Rental demand is then driven by business opportunities in that district. When there are businesses, there will be a higher influx of working tenants.

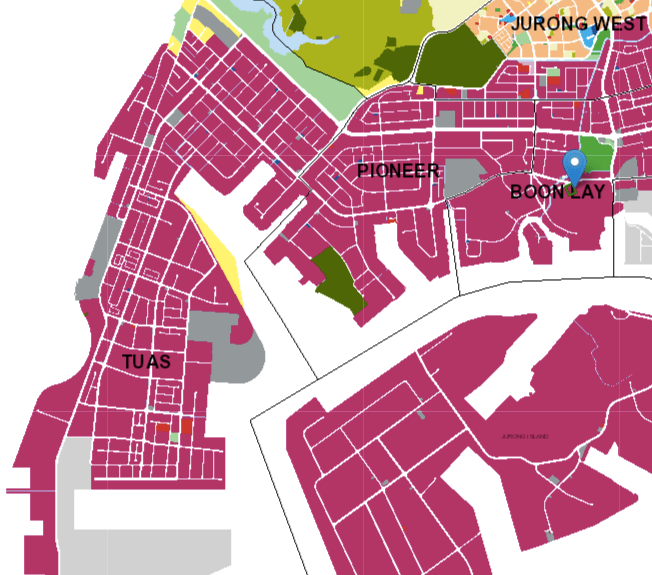

Maroon red on the Masterplan represents Business 2. (Heavy factories)

When you look at the locality of these 3 properties closely, North Park Residences and Centris seem to have more common good attributes compared to Watertown.

North Park Residences (NPR) at Yishun MRT Station

Assuming that you are a young family today who wishes to buy only in Yishun, or a tenant who has to live in Yishun due to his job requirements, they have very limited choices in terms of private property. NPR is surrounded by many HDB Flats, and the next available condominium, Nine Residence is 1km away. This unique factor made NPR the one and only choice for buyers and tenants to consider to live in.

Purely HDB Flats surrounds North Park Residences

Heavy industries spread over the entire Woodlands, Admiralty and Sembawang industrial zones.

These attributes, I believe helped NPR investors register profits over a short 4 year period. The lowest profit an investor made at NPR, $115,000.

High capital gains at North Park residences in 4 year period.

Centris at Boon Lay MRT Station

Similarly, after doing my research, I reckon that Centris is like an elder brother of North Park Residences. It is surrounded by many HDB Flats, there are no competing condominiums near to Boon Lay MRT (which used to be the last station on the Western Line).

Today, this line is extended to Tuas Link, the extreme west of Singapore, and if you notice, it passes through Pioneer, Joo Koon, Gul Circle. This is our one and only Jurong Industrial zone.

Jurong Industrial Zones – many times larger than Punggol & Sengkang combined.

Tuas, which is a few times larger than Punggol and Sengkang combined provides infinite tenants’ demand. Not only that, blue and white collar tenants can also come from offices in Jurong East, Pioneer light industrial zones.

With a vast amount of HDB Flats surrounding Centris, and having no other neighboring competition, HDB upgraders have no other choice than to choose Centris if they wish to continue living in this same neighborhood, where they might be close to their parent’s home or children’s primary school.

This certainly creates a strong buying and renting demand.

Capital upside was huge over a 10 year period at Centris.

However, take note that the investors marginalized $500,000 profits over a period of 10 years. This 10 year period includes the last down cycle in 2009 till date.

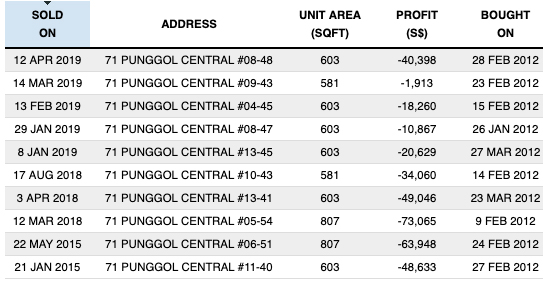

Watertown at Punggol MRT Station

Their performance is the lowest in terms of profit margin across a 7 year period, at only $80,000 on average. And on the data chart, we hardly see transactions crossing the $100,000 profit mark.

Capital gains hardly cross the $100,000 mark.

My personal take on why Watertown did not make much profit? Watertown sits on the last MRT Station – Punggol and has no nearby business hubs. Incoming tenants and investors might choose other “options” before considering Watertown as a good valued investment or for their self stay use. By applying the same previous logic, when the rentability and demand is lesser, rent prices commanding is lower, sales price achieved will dip, affecting profits.

Plenty of private resale options near to Watertown.

In a 2km radius from Watertown, there are also plenty of resale executive condos and private property choices – Parc Centros, A Treasure Trove, Prive, Waterbay, Twin Waterfalls. Despite being a crowded and popular mall on weekends, the rental yields and capital gains seem weaker.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

No integrated development have registered huge losses yet

If you were to spend some time to scan through the price history of integrated development in Singapore, all first purchasers have made capital gains from it, but the difference lies in the horizon timeline taken to make the upside. Investment in properties is all about holding power and your own cashflow.

When market heads south and is in the red, we do not quickly sell it at a loss. Instead we allow the rental market to help us sustain the cashflow until market turns bullish, years later.

No profits for Watertown owners who entered at a higher PSF

Some questions that will run through my mind before I make an investment decision would be

- When can I sell and make a profit? If it is 7 years or more, will it be worth the wait?

- Is that profit sufficient for my family to invest in 2 private properties years down the road?

- Will the next buyer pay $300psf more to buy the integrated development I own in future or will they buy a resale property across the road?

Think about how your next buyer’s purchasing mentality

Would they need to buy your property in future and pay $300psf more when they can go for the newer resale condominiums that are sitting right across the integrated development and hub?

These resale condominiums come with similar pools and full condo facilities. If they need to visit the mall, take a train or bus to the city, it is just a 5 minutes stroll away.

But, fret not. There will surely be buyers who will pay more and buy from you in future. Families who love convenience of amenities and transportation, families who think about the safety of their children, where they can just take the lift down and do not need to risk crossing roads to get to transportation or food amenities.

Moreover, it is a project by Capitaland and CDL – Singapore’s reputable developers who build quality products. Plus, this is going to be one of the grandest condominium in the North Eastern sector of Singapore.

I am very confident you will achieve profits, but by how much and how long?

Let’s take a look at some of the future potential competitors around Buangkok

Of course we are not comparing apple to apple when we compare resale with new launches, but we want to know what are the available options should a buyer or tenant who wishes to enjoy the conveniences of an integrated development but are looking for cheaper alternatives. This time round, we will only zoom into projects that are less than 5 years old.

3 main condominiums right next to Buangkok MRT Station.

This reminds me of Watertown again. Remember that with cheaper alternatives close by, the profits of Watertown is much more tame in comparison with projects such as Centris (In Jurong) and North Park Residences (Yishun).

Sengkang Grand Residences is most likely to launch between $1600psf to $1800psf. Having very much similar attributes akin to Watertown, it seems like some factors might hinder me to regard it as an investment property.

It seems like the price gap between a new project launch and the resale ones (not too old either – 2013 and 2016 TOP) is around $400-500psf at this point of time.

Nonetheless, if you are buying for own stay because you need to be in this location, I don’t think you will lose money so long as you are not speculating and have sufficient holding power. Moreover, for most of the new launches, the prices will increase at TOP.

The convenience offered by Sengkang Grand Residences and the reputable developer, Capitaland & City Developments Limited (CDL) will definitely be able to attract future buyers who wants to be in this location.

However, if you are still looking at this as an investment, I must say that there might be other projects that will probably give you a higher profit returns over a shorter horizon.

You might just want to give me a call or WhatsApp at +65 9007 4405 to discuss your objectives, or simply have a second opinion on what could be the best option you. You may want to submit the form below if you prefer a callback.

Lastly, I recommend going to our YouTube channel next to find out how MDLSG has been helping owners command the selling price they want through the new age method of real estate marketing. 😉.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

If you feel that this article provided good insights on the real estate market, please like it below so that your friends will be able to read this too.