If I were to ask you “what is the first thing you remember about the real estate market in 2017?”

“Crazy en-bloc deals”

“Price index going up for the first time after so long”

“First time hearing developer running out of units to sell”

That’s right, pretty much the same answers I get most of the time. Hold on, with so much market talk going on, are these rumours or truths? Let’s analyse.

How crazy are they in terms of volume and market value?

Since 1994, there were only 3 other peak volumes of residential collective sales besides 2017.

2006: 79 estates sold en-bloc with a value of $7.84 billion

2007: 111 estates sold en-bloc with a value of S$11.9 billion.

2011: 49 estates sold en-bloc with a value of $2.88 billion.

2017: 16 estate sold en-bloc with a value of $8 billion.

The collective sales transacted till date as at end October 2017 is already at 67% of the value transacted in 2007. Imagine how many properties can be purchased with this outflow of $8 billion worth of cash proceeds. I will talk about this in another segment.

I reckon Singapore developers to continue to remain aggressive in their land bidding – the reason being their need to recycle their capital and keep operations going.

The main key question everyone have in their mind now is, how will this en-bloc wave affect the market in 2018?

How will it affect me if I am looking to buy my first property?

How will it a affect me if I am looking to buy my second investment property?

Or what if I want to upgrade from my current property?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Firstly, I Do Not Foresee $8 Billion of Funds From These En-bloc Millionaires To Enter The Market In 2018.

Two thirds of the total value would be a comfortable figure to calculate from, which means $5 billion of value would return to the private property market, or 1782 new homes would be needed.

Yes, I totally would agree that some retiree owners can fully pay a Hdb using their proceeds. However, it would also continue a chain effect where the Hdb owner whom they bought from will be displaced and could likely upgrade into a private property.

If an average replacement home is priced at $1,400,000 (since you cannot buy any decent 3 bedrooms at below this price), $5 billion of value can buy an estimated 3571 homes, taking into consideration Singaporeans usually want to have a second home as an investment.

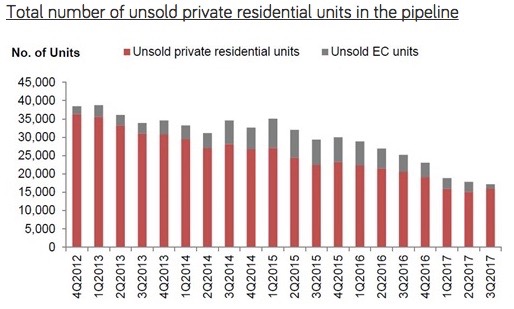

As what Minister Lawrence Wong said on 6 Nov 2017, unsold supply has come down from 40,000 units in 2012 and there are 16,031 units as at Q3 2017. I wouldn’t dispute that some displaced owners are already making plans to buy a replacement home.

The en-bloc wave is highly expected to further reduce the unsold inventory in the next year.

That being said, if you intend to make use of your current asset to either upgrade in 2018, I urge you to be cautious. Sales volume of the private property market has been consecutively increasing every quarter since Q4 2016. In the next year, should a sudden hype of buying trend start, and with current developers’ inventory at its lowest over the last 22 years, prices can only slowly spike up.

Did The Price Index Really Go Up?

Yes!

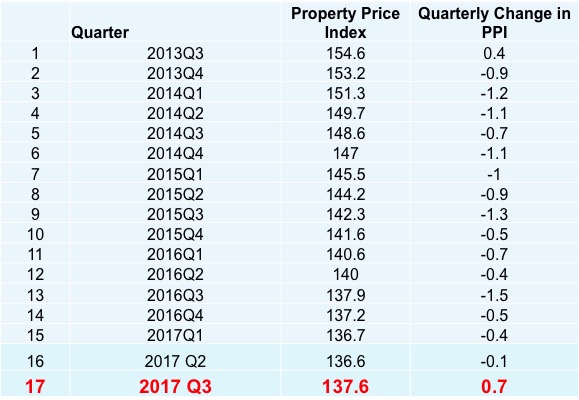

For the first time since Q4 2013, our private property price index is +0.7. Does that mean we are at the bottom of the red hot market which has been cooled by all the measures? I reckon we are.

If I were to compare Hdb and private property price index, this is how it will look.

From 2013 to Q3 2017, Hdb price index is an overall -9.7

From 2013 t0 Q3 2017, private price index is an overall -11.3

Let’s try to put it in simple layman terms.

In 2013, a Hdb owner owns a flat and it is worth $500,000. It dropped 9.7% in value, and today it is worth $451,500. His loss in value is $48,500.

In 2013, another private owner owns an apartment and it is worth $1,300,000. It dropped 11.3% in value, and today it is worth $1,153,100. His loss in value is $146,900.

The difference between 9.7 and 11.3 is not much but in absolute figures, there is a vast difference. The Hdb owner only lost $48,500 but the private property owner lost $146,900. Now today, if you are a Hdb owner, would you want to take advantage of this loss of value on a larger quantum and try to pick up great buys in the private market? I bet you should, since Q3 2017 results has already shown a +0.7.

Some Hdb owners at this juncture tells me this, they want to wait till market picks up further before they do an upgrade. So, being an investor myself who loves calculating numbers, I came up with this analysis.

A Hdb owner has a flat value of $500,000 and assuming prices go up next year by 5% for him, he makes an extra $25,000. He is going to then, upgrade to his desired private property after this. Hold on, if Hdb prices can go up by 5%, private property prices should also go up between 5-8%.

If he were to buy a home which costs $1,300,000 now and we factor in just a minimal 5% gain, he would have paid an extra $65,000 in the better performing market! Did he end up paying $40,000 ($60,000 – $25,000) extra just by waiting for the market to pick up?

I have spoken with countless of owners who are looking to upgrade their properties. By upgrading it means, selling away a lower current property value and buying a higher property value. Majority of them agree with me that, a property upgrade should always be done in a low or poorer market, and not in a good uptrend market.

If you want to find out what you can do with YOUR current properties (because everyone’s profile is different), reach us by filling up the contact form below.

Need to understand more on how others have done it before you decide to take action?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Take A Look At How This Investor Made A Paper Gain In 7 Months This Year.

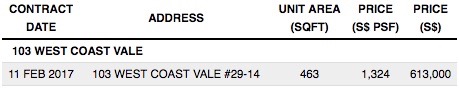

#29-14 was transacted in February at $613,000, just before the en-bloc wave started and before all the buying hype set in.

#13-04, a similar size unit was resold by the developer in Sep at $616,000. Over a short span of just seven months, the owner already made a slight gain on his investment. Fortune favours the bold.

Now ask yourself, if this wave picks up and you miss it again, when will the next low price happen in our property cycle? Do you have the age to keep up with the next cycle? We are only getting older as we wait for the future unknowns to happen.

Am I Able To Still Catch The Market Now And Get Fire Sales or Discounted Units?

In September 2017, this 2 bedroom unit at Reflections was put up for sale at $1585psf. This price is an exact psf price ten years ago. Yes, ten years ago. Are you able to recall what was the market like in 2007? It was also the year of records en-bloc transactions and value. Who says price reversal is not possible ten years later in 2017?

So what actually happened?

Keppel Land decided to sell 30 units that they own into the open market. These units are priced from $1400psf, which is a price last seen in the 2007 period. Keppel even offered deferred payment schemes to entice buyers.

No one ever expected Keppel to release these units under their portfolio for sale in such a short notice. Even my buyers are caught by surprise. A few of them are able to place cheques for those units for sale, but they all faced one common obstacle. They need to sell their current place first before they can make the next purchase.

Needless to say, by the time they managed to sell their property, the cheaper priced units at Reflections were also sold! They missed the golden opportunity. However, I felt that this missed opportunity can be mitigated. How?

Warren Buffet ever once said “Cash is king”.

But it’s not king if your cash sits there and does nothing. Opportunities do happen but are you ready to seize it when it comes?

Should I Buy Now or Wait?

In the market today, my client is still able to purchase a city fringe brand new 3 bedroom at an average psf of $1500. And by city fringe, it means this project is only 4 direct MRT stations stops to Orchard. Now, these are the prices you will lock in if you decide to buy this year. Average $1500psf or $1,500,00 for a 3 bedroom.

What can happen if I wait? Now in the next year, developers will be launching their projects which they purchased from the GLS schemes. These are the potential sales price is terms of PSF.

Look at (3) Tampines Ave 10. The projected selling price is $1300-$1350psf for a suburban project with no nearby MRT stations now or in the future. How does this compare to a city fringe property priced at $1500psf? Once this project at $1500psf is sold out, it will now make $1300psf at Tampines the cheapest to buy at. When buyers start committing in Tampines at $1300psf, wouldn’t the initial investor on the city fringe project have also made a slight gain in 2018?

The launch prices in 2018 of a outside central region (OCR) property will definitely be higher than what you can buy in 2017 for a rest of core region (RCR) property.

What About Potential En-bloc Lands Which Will Be Launched?

Rio Casa is sold at $706psfppr. After factoring in constructions costs, marketing costs, profits etc, this might be the potential launch price.

Purchase Price: $706psf

Possible Launch Price: $1386psf

Planning forward, if we are anticipating that buyers will commit to such prices when Rio Casa is launched, does it make a city fringe project at $1500psf more lucrative to buy today?

What about Serangoon Ville which was sold higher than Rio Casa at $835psf? You do the sums yourself.

Many home owners I have met did not anticipate that its takes 2-3 months to sell a property but it takes an hour to purchase one. Home owners must always plan their timeline forward.

Do you need to have your first property sold before you can do a next purchase just to avoid Additional Buyer’s Stamp Duty (ABSD)?

Do you need to redeem your first loan so that you qualify for a new 80% loan from the bank?

Do you need your sales proceeds from the first property to fund your next property purchase?

We can never time when another developer will release discounts but we can ensure that we are ready to make the purchase anytime the opportunity appears.

With that being said, I want to reach out to home owners and investors who want to find out how they can maximise their funds to grow their assets while riding the en-bloc wave next year. Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

If you feel that this article provided good insights on the real estate market, please like it below so that your friends will be able to read this too.