The first week of July 2018 was one of the most frenzy and crazy week for the real estate market.

First on Monday, URA released flash estimates for 2Q 2018, with the property price index rising 3.4%, slightly lower than the 3.8% in 1Q 2018, but still reflective of the high momentum in the market. Until Thursday, a bombshell dropped late in the evening.

Another Disruption?

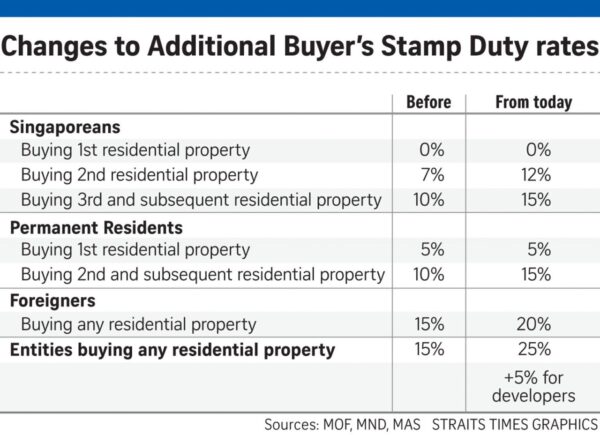

On 5 July 2018, MAS implemented immediate cooling measures to slow the rising market with new ABSD (Additional buyer’s stamp duty) and LTV (Loan to value) enhancements

What Made The Government Pull The Trigger?

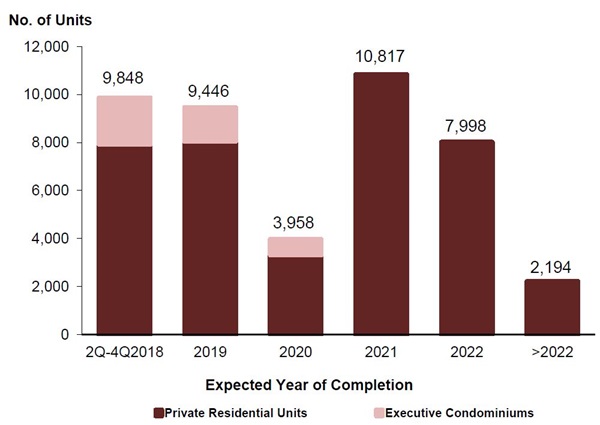

For the past 2 quarters, two variables have increased tremendously. Sales volume and price index. However, with the coupling of global trade uncertainties, potential rising interest rates by the Fed and an upcoming total supply of 44,261 units in the pipeline, this will be a cause of concern for our authorities.

A Cause And Effect Analysis:

These are the potential groups that could be affected with the latest cooling measures.

- First time private property buyers

- Property investors who wants to own a second and subsequent property

- Foreign investors

- Developers looking to shore up their land bank.

Let’s focus on the first 2 groups of buyers which you will find it more relatable.

1. First Time Property Buyers

They are usually Singaporean or Permanent Residents who do not need to pay extra ABSD for their first property purchase. However, their LTV has dropped from 80% to 75%. This means that if they were looking to buy a $1million property, they have to now put in an extra $50,000 in cash or CPF money.

It can only mean that, they have to take a little longer time to build up their savings and cash reserves, or they might feel squeezed out and opt to commit to a HDB Flat first. Since, the measures do not affect HDB LTV at all.

Potentially, we might see an increase in HDB enquiries in the coming months.

2. Property Investors Eyeing A Second Or Subsequent Property

A Singaporean buying a second property is now slapped with an additional ABSD of 5%. (Total of 16%). If you were to recall the previous cooling measure that was implemented in 2013, a foreigner who buys their first property in Singapore will be have to pay a total of 3+15=18% of stamp fees. That immediately killed of buying interest from foreigners from 2013.

A 16% stamp duty to pay for a second property purchase might not be the wisest investment decision.

Taking a $1million investment for example, it will incur a $160,000 stamp fee. Assuming your investment property is fully paid (which is unlikely) and you collect $3000 in rent per month, it will take you 54 months to claw back the $160,000 in stamp fees you have paid.

What we can expect in the upcoming months is a total standstill on buying interest from this group of investors. This might push them towards either restructuring their portfolio, decouple their existing property or look into buying under trust.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

How Can You Take Advantage Of This Situation Today?

Luck can often mean simply taking advantage of a situation at the right moment. It is possible to make your luck by being always prepared.

Within a few days from the implementation of the measures, there were at least 4 new launches that have immediately adjusted their pricing and offered a 5% discount in lieu of the extra 5% ABSD one has to pay for a second property. This is a tell tale sign that prices have to come down in the next coming months.

As long as you remain a first time property buyer, you will stand to benefit from the upcoming discounts from developers or revised pricing in the resale market. The ultimate goal? Figuring a way out to be classified as a first time property owner. (Selling or decoupling will be the ideal method.)

First Timers Stand To Gain The Most!

First time buyers will stand to gain from this 5% discount as they are not affected by any extra ABSD. All I can say is, without the latest cooling measures in place, the 5% discount won’t be given and developers will continue to keep prices running in the bull market.

We have to be prepared that if developers are unable to move their sales, they will have to either close the showroom or adjust the pricing downwards. This will inevitably push down resale prices as well, and when resale prices come down, these genre of buyers who are looking to upgrade with stand to benefit.

- HDB upgraders who were priced out previously due to the widening gap between HDB flat and private properties.

- Property owners who own a first matrimonial home and are looking to upgrade a year ago but gave up due to increasing prices over a short period of time.

Now, it is your time to make your move in anticipation that prices will correct for a short period of time. Catch hold of the “adjusted” prices, and ride the wave when it is back again.

Ending Thoughts

- First time buyers are affected by a reduction of LTV. From 80% down to 75%.

- Second time buyers are affected by ABSD, an additional 5% on top of the previous ABSD.

- Knee jerk reaction by developers offering 5% discounts to offset the 5% ABSD.

- Resale market to follow with adjustments in price.

- In anticipation of a downward trend in price, current home owners should quickly take advantage before one is priced out once measures are lifted in future.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.