It has been 15 years since I started out as a Real Estate Salesperson and I think that I have gained a lot of experience from meeting my many people from different walks of life.

My blog section on property investment insights was started to help home owners in their asset and wealth planning. Mainly, the end goal was to have a comfortable retirement.

Reflecting back now, it somehow feels like a doctor who has seen too many types of illness and got to helping his patient recover from it.

Types of Followers I Have Met Who Strike A Fond Memory

- Private property owner looking to cash out and upgrade to 2 private properties.

- Investor with 1 HDB Flat and 2 private properties who wants to fulfil his dream of living in a landed property and owning a smaller investment.

- Single, age 35 who initially wanted to purchase a million dollar HDB Flat but ended up scrapping that idea – for the good of her future retirement.

- Tenants who got frustrated with landlords and rents, that they decided it was better to hedge their money.

- PR citizens waiting on the sidelines for the removal of ABSD – since 2013.

And many, many more on a daily basis.

Numbers Do Not Lie, And Statistics Are Your Best Pals In Property Investment

Everyone I met has provided me with a certain degree of good experience, which allows me to improve my skills and further value add to my future consultations.

That is where I come to realize, we all have different resources that we must know how to put it to good use. But the common commodity we all have is money. Instead of working hard in our jobs, we can start from a young age and invest the money you worked so hard for, work harder for you through property investments.

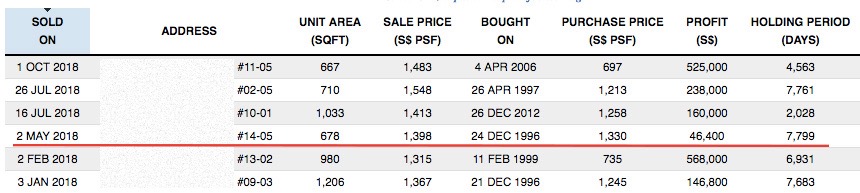

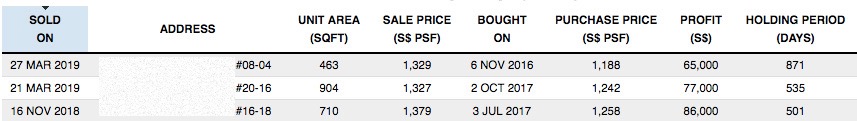

Thus, you wouldn’t want to commit painful mistakes like this. You might end up holding onto a property for 22 years, and still stay status quo.

Or would you prefer to hit a bulls eye and walk away from a short period investment?

URA has provided open data to sales and rental transactions on properties since 1995. It is my expertise to digest these data, and translate what it means to you during our consultation. I will then provide a

- Detailed financial assessment on your current property portfolio and cash assets

- Then offer you at least 2 options to fine tune it and enhance the growth for the coming years.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

For The HDB Owner Who Owns A BTO or DBSS and Has Passed Your MOP, This Is What You Will Gain From My Sharing.

Pin point the exact period when a MOP flat achieves the maximum profits.

- Understand where all the new and upcoming BTO neighbourhoods are situated at and how it will affect your resale pricing. I have an article on this.

- How should you move on from your first profitable government subsidised flat and let the profits grow further.

For the HDB Resale Owner:

- Understand the implication of using CPF money to pay down your HDB, and at which exact age, your cash proceeds could potentially be 0 when you sell your flat.

- How can you safeguard against a depreciating HDB Flat value.

- Should you fully pay up your HDB loan and purchase a second private property?

- Is renting out your HDB the only option and how much nett rent are you collecting? How does the yield compare to other investment tools (E.g. Fixed Deposits)

- We will draw out a timeline for your next 10, 15 and 20 years. Will it be risky to own a private property for retirement or should you continue living in your HDB until age 65.

For Owners Who Own 1 Private Property:

- Find out if your property has passed its peak performance stage or has it just started to appreciate.

- Compare your property with other properties shortlisted by me and cross reference, which would be a better asset to hold on to.

- Is waiting for En-bloc the only option for you if you are holding on to an aging property?

- Understand your property’s curve line when it is nearing the 10 year mark or has already surpassed it.

- If you were to upgrade to another private property, how will it affect and change you and your family’s lifestyle and needs.

- Are you able to own a second property without affecting your current cashflow or savings?

- How about taxes like additional buyer’s stamp fees? Can you minimize it?

- A buffer cash reserve that could last you 5 to 10 years without worrying about job or money instability.

And For Owners Who Already Own Multiple Properties:

- Congratulations you should be on the right track to financial freedom at age 65 – your retirement age.

- However, will it be harder to maintain, rent out or sell your current properties in the long future? What should you do before that happens?

- How can you take out some profits and reinvest them into another property with the correct holding manner and thus minimising your taxes?

- Will your children inherit an asset or a liability in the long run?

- Will changing to a freehold or 99 years tenure be more suitable for you?

End note

Having read to this point, you might have the urge to ask me a question on your current situation. I would love to help you and invite you to submit the form below for me to reach out or

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Information is so readily and easily available online these days, and the average investor might already know the basics of investing. What you need today, is a realtor consultant who has spent 10 years being on the ground, gaining valuable experiences which he can share with you and choose the right property to stay invested on.

Your advisor should be more than a mathematical calculator, and should probably effectively help you upgrade your assets and improve your portfolio in a right systematic manner.