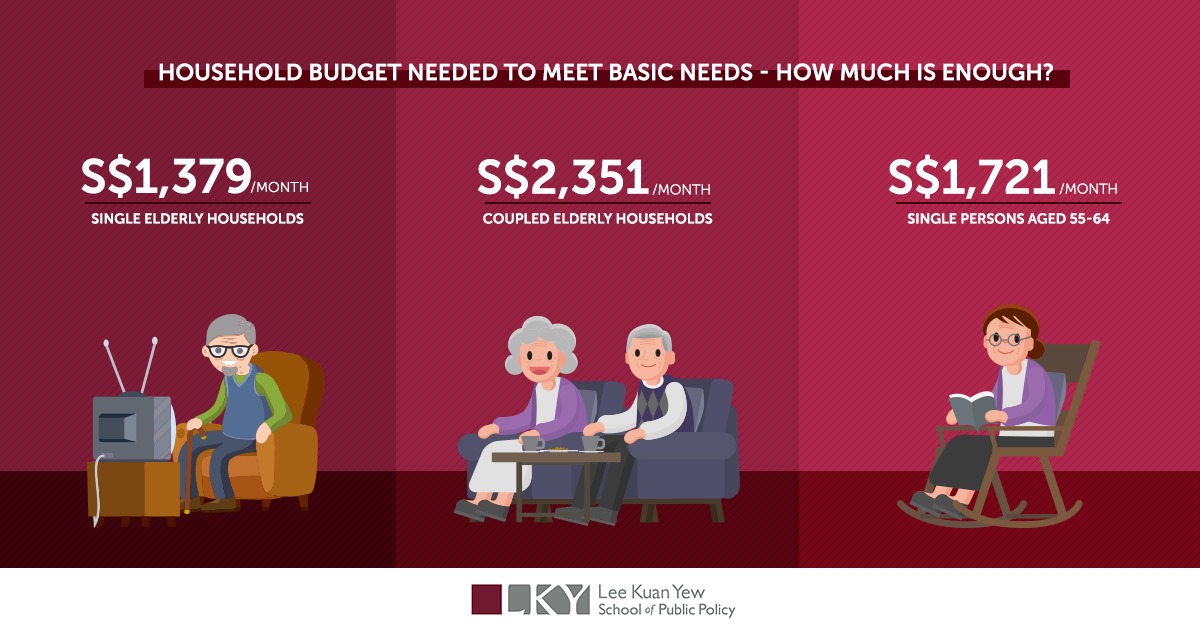

A research study published by Lee Kuan Yew School Of Public Policy released their findings that a single elderly household aged 65 and above would need at least $1,379 a month to sustain their retirement lifestyle.

I can see that most Singaporeans do not believe CPF money is enough to sustain their future retirement needs. Then, people will start looking for options like insurance, annuities etc …

Some others find it hard to find this money, and might depend on payouts from their children, hopefully.

This amount evoked a few thoughts about my parent’s retirement and my future retirement. It made me fear a little about the future, but also provides a hindsight that I should work hard, and invest my money wisely when we are young.

$1379 is in fact a very small monthly figure, not too little and not too much, but it adds up to a huge figure eventually, which I calculated to be rather astronomical.

Let’s assume I retire at age of 65 and pass on at 85 (hopefully, or longer), that’s 20 years of no working income.

I would need a grand figure of $1379 x 240 months, which equates to $330,960. But wait, I can’t possibly forget about my wife right? So that would mean x2,

$661,920.

Let’s also factor in a mere 0.5% inflation rate annually from now until 2039, just like CPF Minimum Sum amount which was at $80,000 in 2003 and on 1 January 2020, it is at $181,000. Now bear in mind that today’s figures are adjusted for inflation.

$661,920 is what you and I need, in order to retire comfortably but this amount will ultimately grow due to inflation, to become $731,352. (0.5% compounded over 20 years.)

A shocking $731,352, an amount larger than what most HDB Flat’s value is today. Average flats value right now go between $400,000 to $500,000.

And here comes the mind boggling question. Where are we all going to find this amount of money to fund our early retirement?

Thus, I always advocate prudent investment to be done when we are at a prime age with proper careers in place and having stable incomes. It left me pondering about some of my followers whom I have met and own different class of properties.

How will this retirement sum affect each and everyone’s retirement future later on? Here, I break them down and analyze.

Property Owner Type 1: Owns His First BTO Flat

With no other property that can generate passive income, their last resort is to rent out 2 individual rooms to sustain their monthly living expenses. However, the maximum an owner can collect from 2 rooms would most likely be $1000 every month, which also hardly covers a retiring couple’s monthly expenses of $2351.

What if they intend to cash out and perhaps live with their children?

A typical young family buys a BTO ($400,000) at the age of 28, and assuming that they live in the same flat until the age of 65, their HDB Flat will then have a remaining lease of 62 years.

At this juncture, we hope that this 37 year old flat will still be able to hold its value of $400,000, but even so, this amount is still insufficient to fund their retirement dream. (Remember the $731,352 we need?)

Bear in mind that when you have fully paid up your HDB Flat, there is a paper value of $400,000 but HDB owners are not allowed to take a term loan against this value unlike private properties.

READ MORE: WHEN EXACTLY IS THE BEST TIME TO MAKE PROFIT FROM A BTO OR DBSS.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Between the age of 45-50 years, we might need extra funds for children’s further education or health reasons. The HDB is unable to provide you for these funds.

Conclusion: HDB Flat owners are recommended to upgrade to a private property earlier on in their lives if they wish to pursue a better retirement lifestyle, which links me to the next type of owner.

Property Owner Type 2: Owns A Resale HDB

The situation is exactly similar to an owner who has bought direct from government and the only 1 difference will be the remaining lease of the HDB. You can say that with the new VERS and SERS in place, there will always be a value on the flat itself.

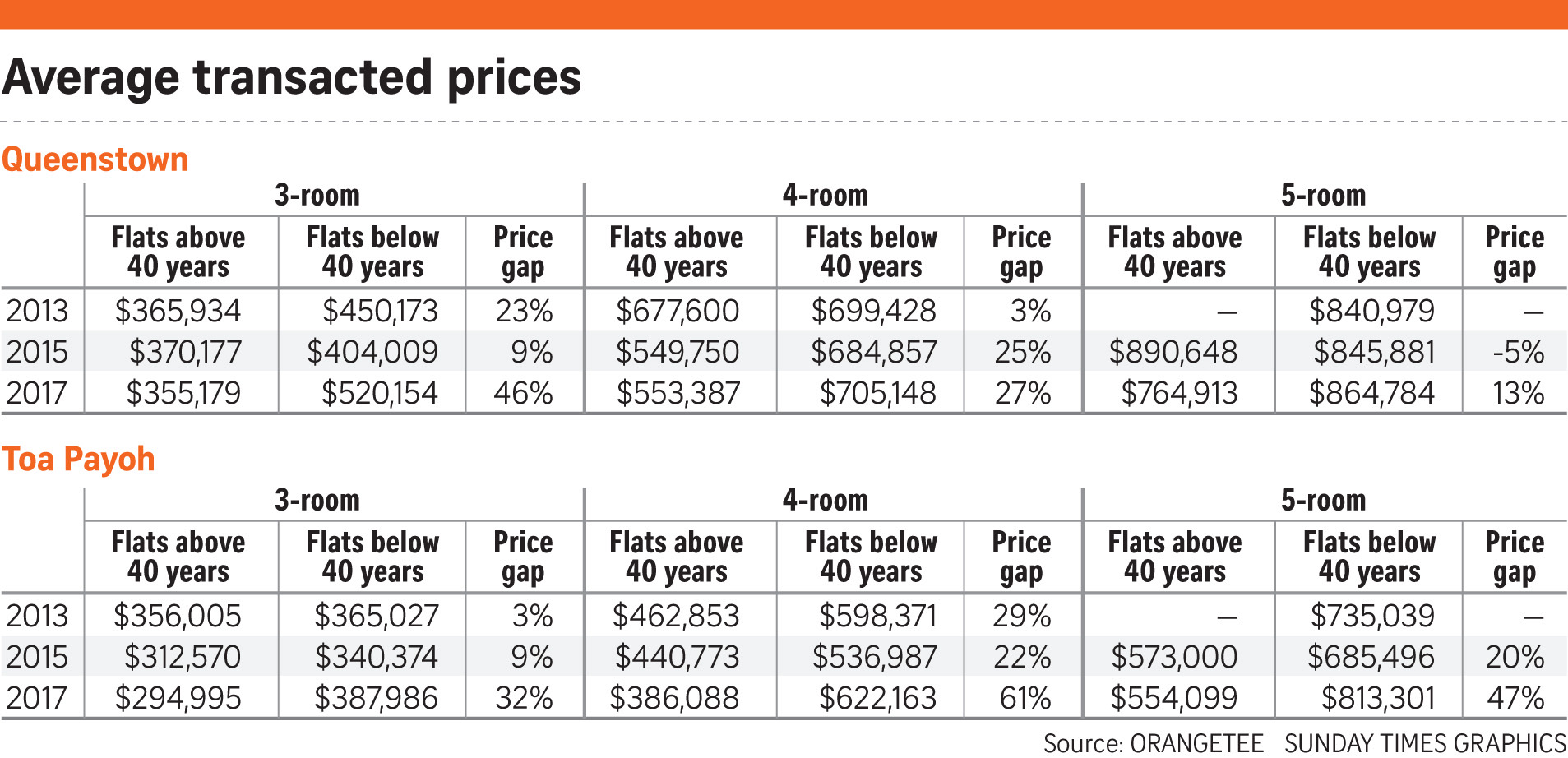

A research done previously for 2 matured and popular estates has shown that the price gap between a flat 40 years or younger compared with a flat 40 years and older can be very wide. This in turn affects your value and the amount of money you can eventually get back from the flat.

Just think of it like a 10 year car COE.

Conclusion: Be mindful about your flat’s remaining lease and your age and family’s needs. Sometimes, it could be better to exit and “reinvest” earlier than losing more value later.

Property Owner Type 3: Owns Only 1 Private Property

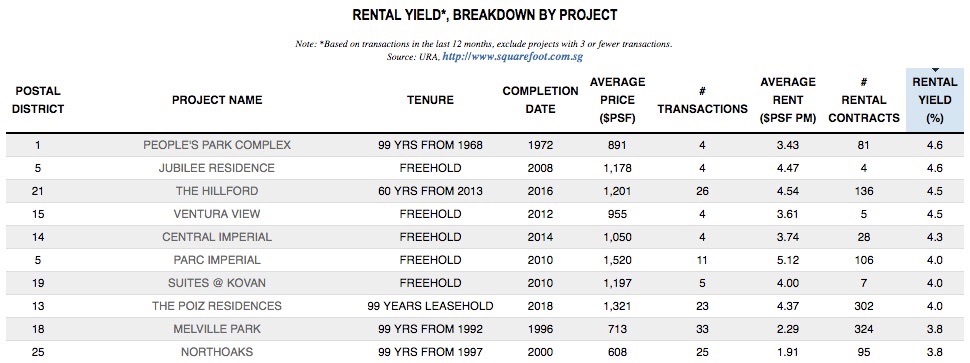

This is usually their home, and once again, they have no other properties to generate passive income. It is also unlikely that condo owners will rent out any of their rooms as I realize that most of them prefer privacy.

Once they reach retirement age, they can either sell it off and downgrade to a fully paid HDB Flat, and use the remaining profits for their living expenses or allow their children to invest on their behalf. Since the older you get, the harder it is to loan under your name.

Alternatively, if it is a freehold property, they can simply rent it out and live with their children. I personally think this is a good idea, as the rent collected per month usually ranges from $2500-$3000.

Conclusion: Being a private property owner opens up many options when you decide to retire. You could either rent out the whole apartment, take a term loan against it when fully paid for, cash out and downgrade to a fully paid HDB or cash out and live with your children, while they reinvest this money under their names.

Property Owner Type 4: Owns 2 Private Property

This is the best and ideal scenario all Singaporeans can dream of. The first home provides for their lifestyle in a private estate, and the second property generates full rental income when it is fully paid for at age 65.

In any case of emergency, they can totally rely on 2 fully paid up properties to support any health issues or even traveling goals.

This is what I call the end state of anyone’s property investment. This is the perfect sweet spot.

The End Goal Is Always To Own 2 Properties

You and I might not have reached this status yet, but it is our choice to take a first step out and upgrade from your current asset to a first private property which can generate profits, if you are a HDB owner or switch your property to a better performing one if your current private property has already been stagnant in growth for years.

When you have achieved your first property and register profits on it, then you can restructure into 2 private properties. Now you see, to reach the end goal, it is always the first initial step which is crucial to how you and I retire eventually.

I welcome you to have a chat with me to understand your current situation and how we can plan together to ensure that you reach your investment and retirement goals faster.

If you are ready for a property and financial assessment, read more on what happens during a consultation here.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.