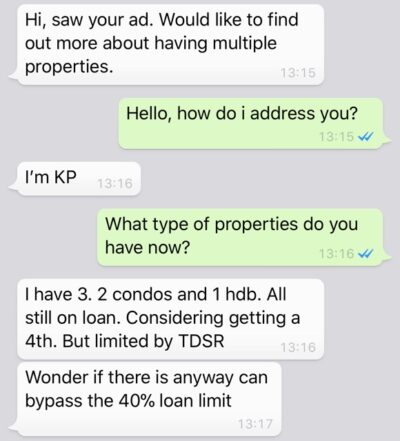

Just last week, a follower wanted to meet me after reading a previous article of mine. I waited for him to fly back and had a lengthy 2-hour discussion with him at Starbucks. The analytical charts that I shared in that article intrigued him so much; it made him think about his retirement plans, and current property portfolio position.

He owns 3 properties at this moment.

I wasn’t so sure about his intent on meeting him, Well you see, an investor who owns 3 properties hardly needs to do anything to it except to shake leg and collect rental monthly.

So I asked, “Why do you want to still meet me since you are already a landlord collecting rent from 2 out of 3 of your properties? Your portfolio is the ideal end goal of almost everybody!”

Then he shared with me quite a little bit about his family, his retirement dream home – which is to live in a neighbourhood where he resided when he was young. Also, he wishes to hear from another person’s perspective and fine tune and reassess the “health” of his other 2 investment properties.

Prior to meeting my followers, I will always ask for the profile of properties they currently hold so I am well prepared beforehand, understanding and digesting the project information and I can have a more productive session with my followers. Time is precious for these busy people since they have made time to meet me.

I was a little shocked when I saw the statistics for one of his leasehold property.

Let Me Share With You What I Analyzed

- Located in Serangoon/Hougang vicinity

- Has a leasehold tenure starting from 1996. The age on the land tenure this year will be 23 years. At this point, you can also analyze property profiles the way I do, and it can help you to minimize pitfalls on your next purchase.

- Collects a gross rent of $2100, but the nett income after costs turns out to be $1100.

- Found it harder to secure a tenant at a good rental rate.

The First Red Flag

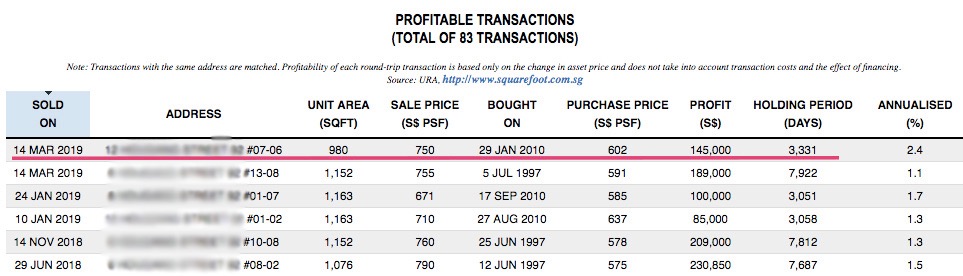

I observed that this property has shown a slow gain over a 9-year period. If we look at the last sold unit in March 2019, you can see that from the purchase period in 2010 till date when it was sold, the PSF gain was only $148psf ($602psf to $750psf) over a 9-year period. Comparing this gain to the other properties I have managed for other sellers, this is a very slow gain.

The Second Red Flag

Most experienced agents can spot this easily. Under the unprofitable transactions of this property, it lodged a total of 14 properties that took a loss. These owners seemed to have bought at a high price between the years of 2011 to 2013.

A normal investor might say that these investors entered at a high price of $817psf and adding on that prices did not edge up over the years, coupled with a weaker rental demand on an aging property, it forced investors to take a cut and sell at a loss.

WRONG!

Look at the charts again, one investor bought at $817psf in 2012. If you wish to invest in a similar type of property profile that is over 20 years old, be mindful of its price history. In 1998, the transacted price was as low as $351psf.

Look at it this way, if you bought it at $351psf and simply need to sell at $700psf to make a decent profit (when market is not performing as well), would you cash out and move on?

You Would Right?

However, when you cash out at $700psf, it affected the investor who bought at a high of $817psf. This is the fall back of buying an older resale property for investment or even for home stay.

By selling at a price lower than what they bought at, it affects the valuation in the estate and future buyer’s expectations to buy a unit here.

The Third Red Flag

I realized that his property was surrounded by not 1, not 2 but 3 new launches totalling 3400 units altogether, which will complete from 2021 till 2023.

Let’s assume that 50% of these units are for rent later on, it is still a shocking figure of 1700 units in the market.

I told him this, based on my ground knowledge of having helped my owners manage their rental portfolio over the years, whenever there are new launches surrounding a 20 year old project, the tenant in most cases, will of course choose the newer one with better and more facilities. And slowly, when the older estates feel the competition, landlords have to reduce their asking rents thus pushing down the yield in the estate.

Florence Regency En-bloc. Credits: Straits Times

Right now, this is what I call, “Calm Before The Storm”

In most cases, investors do not feel the brunt until things happen. They do not feel the dip in rent until a competitor surfaces. They do not feel the capital loss until a next owner decides to call it a day over his wrong investment decision.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

3 Red Flags Raised On Just 1 Property

- Slow gains over a period of 9 years

- 14 unprofitable transactions in a short time frame

- 3400 newer units popping up near to the property

It made me wonder if other 99 year leasehold properties in this area perform the same way.

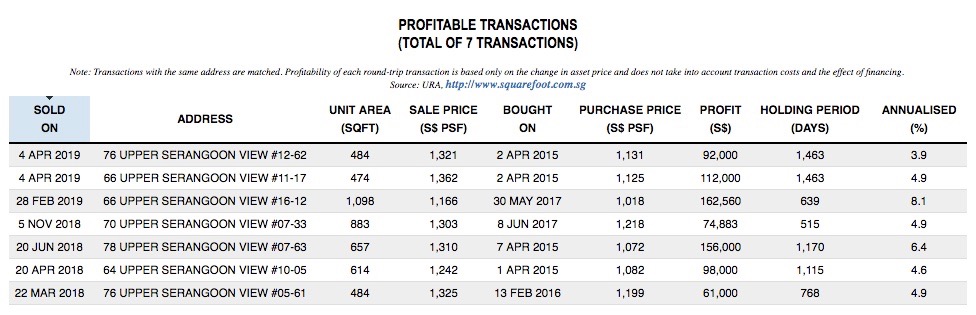

Less Than 3km Away, A 5-Year -Old Project

This project in the same district totally outperformed the aging one. As you can see, within a 4-year holding period on a small investment, 474sqft, that investor gained a profit more than the other investor who stayed on for 22 years.

Some positive points to share here:

- Everyone bought at the same purchase price and are not prone to price fluctuation as the project doesn’t have a long history – just 5 years old. No one will sell at a price lower than what they purchased at.

- There was demand at the point when these investors put it up for sale when the project was completed. I reckon the reasons were that they are totally new apartments and within affordable purchasing price.

- The developer had a last 5% of unsold units but finally sold at a much higher price as market could support. This resulted in a paper gain for the initial purchasers.

It could be a good time to make a few important decisions and restructure his investment portfolio. But we are stuck!

The reason?

He currently owns a HDB and lives in it. The flat has been fully paid for and he feels prices are not going to climb further and wishes to take profits and upgrade.

He owns a third property which already has capital upside and collecting good rental income, and he wishes to keep this for another few years.

Now you see, when he sells the HDB (1st property) and also sells the 20 year old property (2nd property) that is underperforming while keeping the last one (3rd property), he still cannot buy his retirement home because of the potential ABSD he will incur on a second property and lower loan to valuation (LTV) he can get for his second loan.

Recent updates on housing rules:

- A Singaporean buying a second property incurs an additional property tax of 12%

- With an existing outstanding loan, the second loan is capped at 45% loan to value (LTV). Example: You can only borrow $450,000 on a $1mil property.

Begin With The End In Mind

In order for him to buy his dream home today, he is forced to sell off the 3rd property, which performs the best for him. This is a common scenario of a not too ideal timeline planning.

If you happen to fall into this similar scenario, the right way of planning would be to buy the larger quantum property as the first, which usually is your residence and preferably using a single name. Then, it will be less taxing to acquire a second property for rental income.

Today, you might be a HDB owner, or a 99 year leasehold aging property owner or even a multiple property owner who is exploring various options to maximize your portfolio. Run a 5 year, 10 year and even up to a 20 year timeline projection for yourself before committing to any property transaction.

It can be a little tricky to plan ideally these days when our government has implemented various cooling measures, rules and regulations, loan restrictions and many tiers of taxes.

I would be happy to sit down together with you, hold your hand and walk through the whole planning process together, but first, let’s do a non obligatory consultation.

Click here to WhatsApp me at +65 9007 4405 for any queries or submit the form below if you prefer a callback.