I had the privilege to visit a friend’s place last night at one of the earliest pilot DBSS project for public housing. There was so much fan fare during its launch in 2006 when HDB said these public housing will be built by private developers and will come with special fittings such as built in cabinets.

He then pointed out to me across the street, “This DBSS scheme was eventually suspended in 2011 after public outcry over overpriced unit on that DBSS”, he said.

Then, I took out my phone and googled for the history behind “that DBSS”. That development was sold from a starting price of $778,000. No wonder our then MND Minister Khaw Boon Wan had to step in and suspend the DBSS scheme.

And I was like wow, that means my friend could be sitting on quite a tidy profit by owning a public housing.

Indeed he was.

He showed me around his house, showcased to me his extensive renovation done when he shifted in and also told me that most of his neighbours and friends here are aware of the prices inching up year after year. He has a plan to sell and upgrade 3 years later.

And it’s true, his DBSS was built to replicate a condo living environment.

That statement actually strikes me and left me pondering for a second. When exactly is the best time to exit a BTO or DBSS and make the most profit out from it.

When it was launched in 2006, Five-room units in this DBSS originally went for $308,000 to $450,000. As we all know, the construction period is usually 4 to 5 years. The first batch of owners collected their keys in 2009 and the Minimum Occupation Period (MOP) will be around 2014.

Myth 1: My HDB or DBSS’s Prices Will Still Continue To Rise In The Next 5 Years After MOP

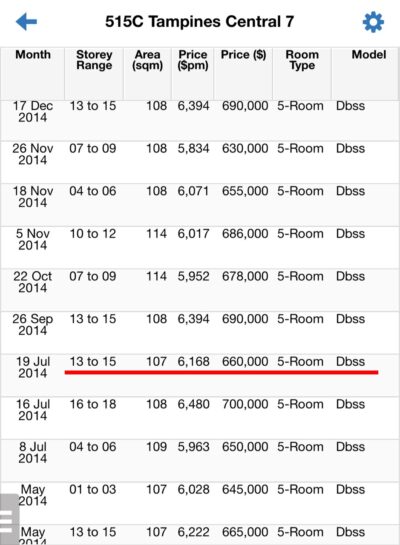

In July 2014, a level 13 to 15 unit was sold at $660,000. That’s almost a whopping $200k profit in 5 years!

On 9 Mar 2018, a similar sized unit on the same level was sold at $703,000. That translates to an additional $43,000 profit, 4 years after MOP.

Transactions in 2018

There seem to be some truths on making profits from BTO and DBSS units, where the longer you wait, the higher you can sell it for.

By waiting for another 4 years, a unit in the estate potentially has gained a 6% and in absolute cash figures, that translates to $43,000.

Now, having met so many investors with different standards of investment returns, I do not think that the $43,000 profit derived over the next 4 years is a “bonus”.

To most HDB home owners, this money would of course be a good amount. It can easily be anyone’s annual income.

But, what if the home owner knows the correct way to invest his $200,000 profit made in 2014 to generate another $200,000 in the same 4 years? (2014-2018)

Is it really possible?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Myth 2: Other Types of Properties Will Grow At The Same Rate Similar To My HDB or DBSS.

I scored through various projects that left a deep impression in me many years ago, and I recall them buying at a good entry price. They should be sitting on good profits and some might even have sold their property immediately after 4 years. Remember the old Seller’s Stamp Duty (SSD) period was 4 years.

If my friend had chosen to cash out his DBSS in 2014 and bought another property immediately after selling, his profits made between 2014 – 2018 is proven to be easily 4x what his DBSS could help him make. However, the very common reason why my friend and most homeowners chose not to sell or move out is usually based on emotional reasons.

– Aiya, my parents are living close to us, can take care of my kids.

– My kids pre-school/primary school is downstairs, it is difficult to move now. (Will be more difficult to move in future especially when a second child comes along.)

– We are used to living in this neighbourhood, why trouble ourselves to buy and move again?

You might have these similar reasons when someone speaks to you about asset planning I guess. Nothing wrong with that, ultimately everyone walks a different path in life.

Myth 3: Paying Off My HDB Loan ASAP And Renting It Out Is My Best Option!

This is the most common comment I receive whenever I meet an HDB owner during my 1 to 1 consultation. While it may seem lucrative to pay off the loan and rent it out, I beg to differ. Simply because I see more hidden costs in this method.

Let’s take my friend’s DBSS for example again. Assuming he pays off at the $450,000 price he purchased at, and this is mostly done with CPF money, what are his real outgoings costs and nett receivables?

Let’s take the last rental contract he potentially can receive.

Annual rent collected: $27,000 ($2250 x 12)

CPF money used on the loan: $400,000

CPF annual accrued interest: $10,000

SC&C Annual Fees: $720

Agent Fees: $2407.50

Property Tax: $1200

Income Tax (8% bracket): $1813

Final Nett Rental Profit: $10,860

Now, while it seems like $10,000 is a cool passive income to receive every year, but is it?

Remember your current property’s worth is $700,000? That is to say, your return is a mere 1.42% on value. This is so much lower than CIMB’s fixed deposit rate of 1.95% today!

May 2019 fixed deposit rates

Myth 4: HDB BTO Prices Will Still Increase Over The Years As The Total Amount Is Smaller.

I recall having met an owner at Blk 302C Punggol Place, years back. He vividly told me that his location is one of the best in Punggol. Being next to main Punggol MRT Station, bus interchange and Waterway Point Mall.

Punggol MRT Station

Well it seemed like 3 years after MOP in 2015, the prices haven’t changed much even with a number of good amenities just next to his flat. It proves that, even with an ideal location, prices don’t seem to nudge up anymore further years after its initial MOP.

Summary

For me, I see asset planning and investment as a way to financial freedom eventually. What do I mean?

The first BTO or DBSS has helped you to gain a fast stepping stone, generating good profits by allowing you to buy at a lower rate from the government. By using these profits correctly, you can gain from the next stepping stone, allowing you to leverage on your profits to make another round of profits.

Now, when you have 2 opportunities on profit making

- First pool of profit made from BTO/DBSS

- Second pool of profit made by reinvesting on right private property.

Imagine this, if you are able to make 2 good pools of profits at a prime, younger age, it is easier eventually to move on to your third stepping stone. Which is: Owning 2 private properties, and collecting good passive income from 1 rental property.

Wouldn’t you be on a faster track to easier retirement and guaranteed financial freedom at age of 65?

But, do take note that everyone owns a different type of BTO/DBSS in different neighbourhoods that grows at different rates. I welcome you to have a chat with me to understand your current situation and how we can plan together to ensure that you reach your investment and retirement goals faster.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

If you are ready for a financial assessment, read more on what happens during a consultation here.