Recently, Tengah Town has been a hot topic, and many are wondering whether it is the next Punggol with plans of various amenities to be built around the area, or whether it will be the next One-North with the nearby Jurong Lake District, a predicted next business hub. As a result, Tengah Garden Walk EC, the first condo in Singapore’s newest town, has caught the attention of many.

Some are excited to join in the hype of first mover’s advantage in hopes of getting great returns, whilst some remain skeptical about its resale price. There is certainly lots to ponder about Tengah Garden Walk EC. Hence, let me slowly unpack with you some of the considerations you should have before jumping to conclusions about whether the EC is worth it.

Tengah Garden Walk EC (Source: HDB)

Some of the concerns I have heard buyers raise about Tengah Garden Walk EC were its inconvenience and inaccessibility. Many coin it the “bird no lay egg place” for the upcoming few years as it will take time for amenities to complete. Therefore, with the lack of amenities, many buyers wonder if this will affect the property’s value should they sell it in the future.

‘Ulu’ = Low returns?

A common belief about ECs is that they are built in ‘ulu’ locations in exchange for the more affordable price tag. That being said, despite its locations, it looks like some ‘ulu’ ECs which have recently MOP-ed in the West are making good profits.

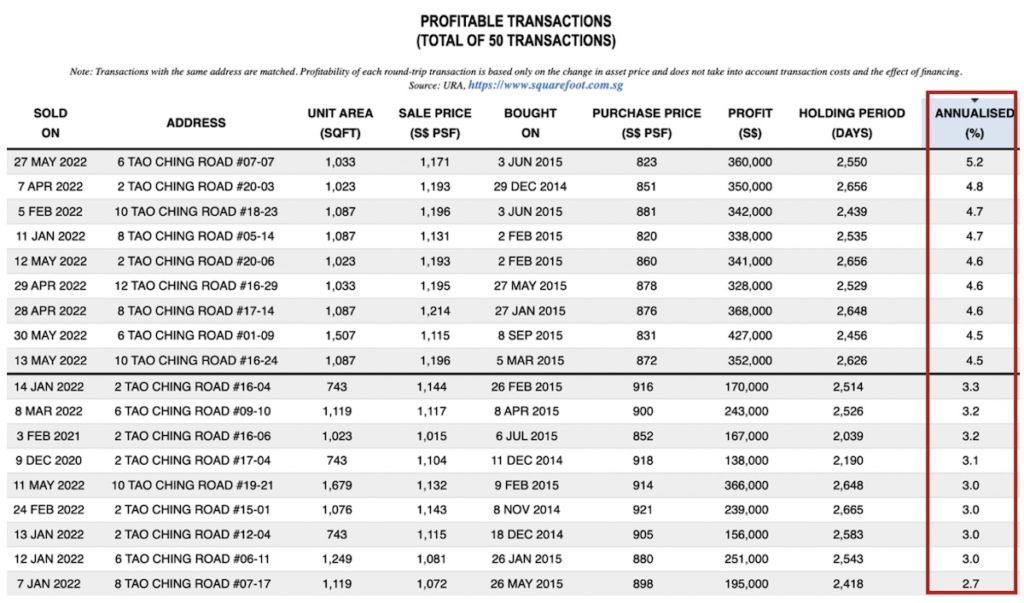

Lake Life EC has recently reached its MOP and sellers have been making an average of $300,000 profit.

Lake Life EC

(Source: Squarefoot Research)

Highest Profit: $372,000

Lowest Profit: $138,000

‘Ulu’ Scale: 20mins walk away from Lakeside station

Westwood Residences is another EC which sellers are nearing their MOPs. As of now, sellers have been making an average of $200,000 and it will probably increase in the following year when more sellers reach their MOPs.

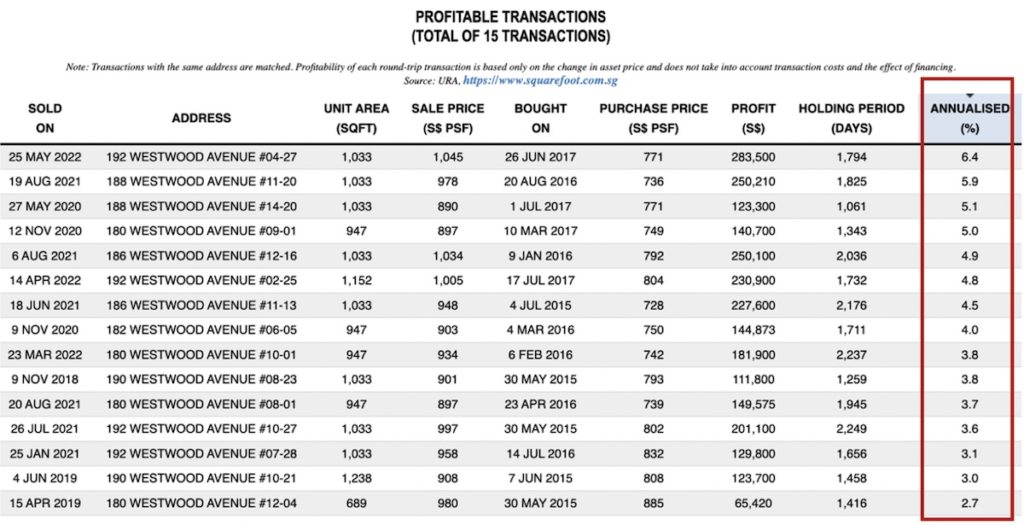

Westwood Residences EC

(Source: Squarefoot Research)

Highest Profit: $283,500

Lowest Profit: $65,420

‘Ulu’ Scale: 22mins walk away from Pioneer Station, Gek Poh MRT Station (0.5 km) for the future Jurong Region Line (JRL)

Tengah Garden Walk EC is located between the upcoming JRL Tengah station, Hong Kah station and Tengah Plantation station which will open in 2027. By the time the EC’s MOP is over, it will be conveniently located between the 3 stations and this will likely further raise its capital appreciation. As of now, the nearest MRT station is Chinese Garden, 2km away.

Source: The Straits Times

Honestly speaking, resale ECs will always be in demand and more often than not, you will get some returns.

If you are reading till here, I would guess that you fall under at least 1 of these 3 categories.

- HDB Owner who is looking for an upgrade from HDB to an EC

- HDB Owner who is conflicted between an EC or Condo

- “I just kaypoh…”

For My Readers In Category 1,

You would have probably heard from several websites that ECs are great value buys as you are basically buying what is to be a private property in 10 years whilst enjoying government subsidies. ECs are thereby especially attractive for the sandwiched class of those whose household incomes have exceeded the ceiling for public housing but are unable to qualify for a private condominium.

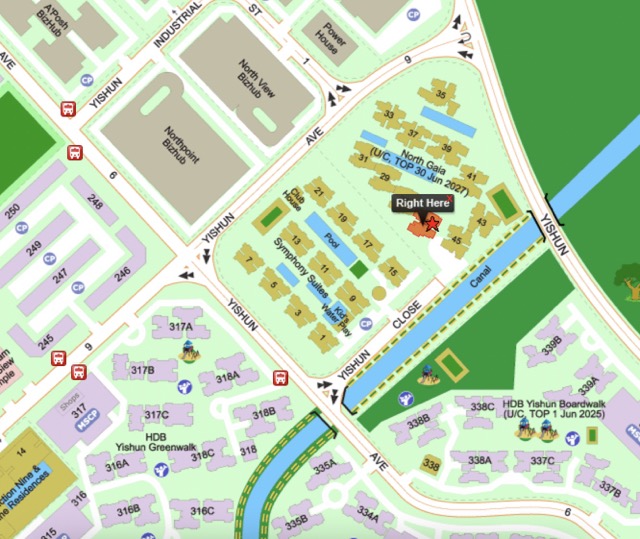

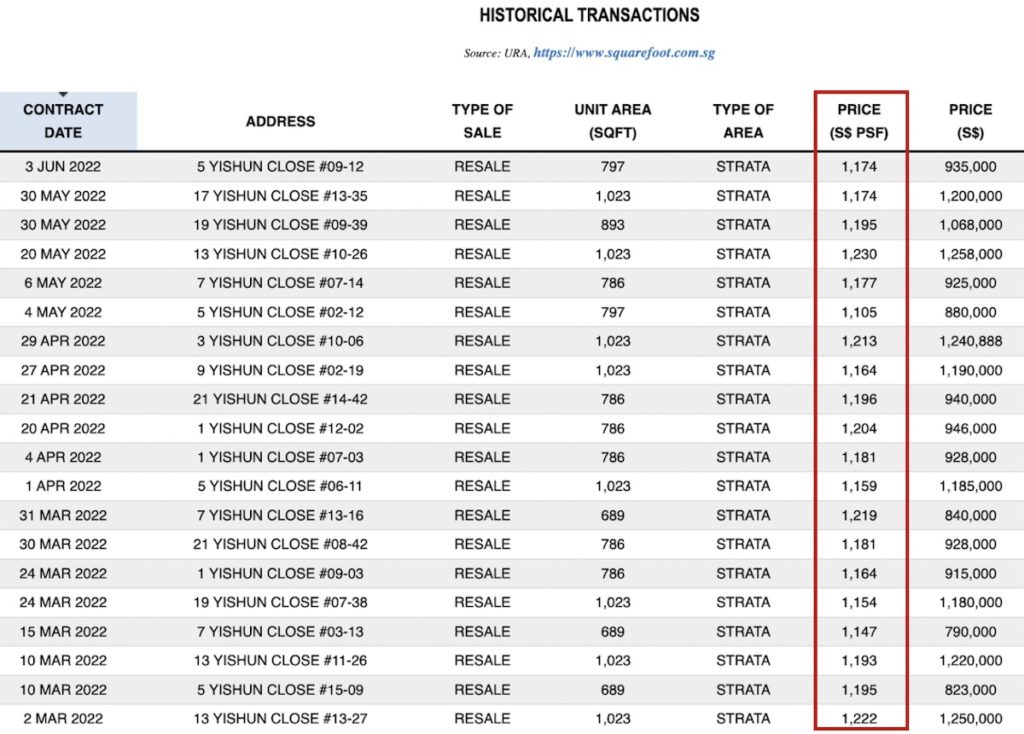

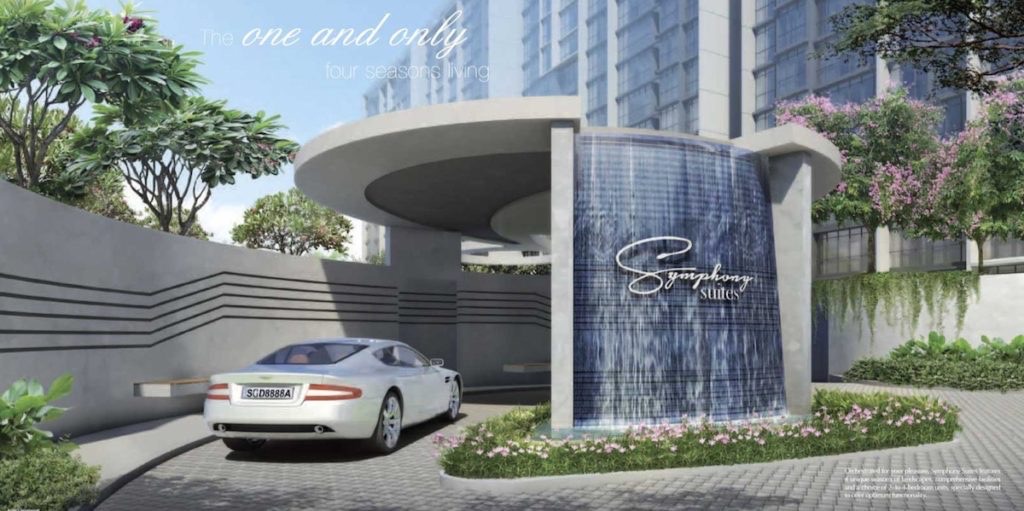

However, we have recently seen an influx of new launch ECs sold at a high price comparable to that of private condos. For instance, North Gaia EC, a new executive condo launched in April this year is sold at about $1,300 psf while Symphony Suites, a private condo right next to the EC is sold at an average of $1,180 psf (resale).

The property market is becoming more volatile as each day passes and it can be hard to be on track with the latest updates. Unsure how you can better upgrade your property portfolio and make better investment choices?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

The Case of North Gaia

North Gaia. Source: Streetdirectory

The appeal of EC originally lies in its affordable price in comparison to private condos. So what happens when EC prices become as high as mass market condos? Do ECs then lose their appeal?

On its launch weekend, North Gaia EC sold 27% of its units.

Source: The Business Times

As of the time I’m writing this (4th July 2022), the sales have remained stagnant at 27%, although it has been slightly more than 2 months.

*North Gaia’s launch weekend was on 23rd and 24th April 2022

North Gaia average psf: $1,300 (Source: Squarefoot Research)

Symphony Suites average psf: $1,180 (Source: Squarefoot Research)

However, it is a stretch to conclude that the price gap between Symphony Suites and North Gaia EC is the sole reason for this occurrence. I’m sure there are other reasons and considerations from buyers. However, it is certainly safe to assume Symphony Suites had a role to play in the 27% take up rate.

When prices of a new launch EC and resale condo are so competitive (in this case, the latter’s being lower), it might make more sense for buyers to go for the condo since there isn’t any wait time.

Symphony Suites

Although I did mention above that ECs will always be in demand, that only applies for resale and doesn’t extend to new launches. It’s the same logic as resale condos. In exchange for the higher price tag, buyers do not have to wait for MOP and can move in immediately.

Before I move on to discussing whether condos are thus better choices, I would like to warn my readers that though resale ECs may always be in demand, it does NOT mean that ALL are profitable!

It’s Not Always All Sunshine And Roses For Resale ECs

Let me share with you a short history lesson here.

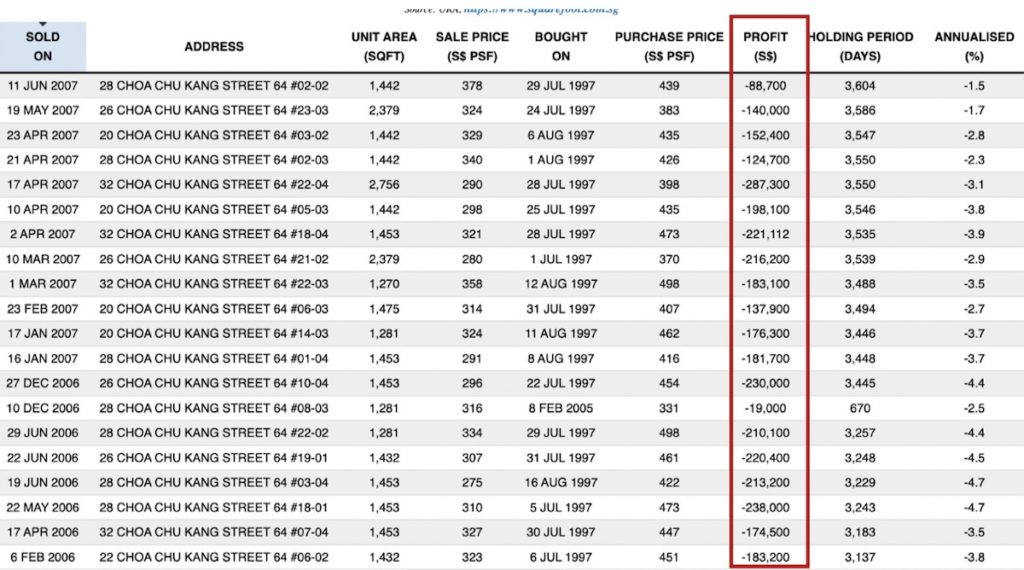

In 1997 when Windermere was launched, it sold out quickly and was definitely peaking. Turn to the 2007s and…

Sellers who bought Windermere EC in 1997 made huge losses. (Source: Squarefoot Research)

Despite the Asian Financial Crisis in 1997, Windermere was still able to achieve amazing sales. It seems like the success from then wasn’t able to tide through the 2007 Global Financial Crisis.

The reason I brought this up is because I would like my readers to know that buying a EC does not always equal a safe choice and good returns. No one, not even the top property agents, can ever make such generalisable statements in the property market.

Wait… Is A Condo Then A Better Choice?

Okay, now back to the current. This question has always been a popular one and you might have seen it pop up several times in various pages on property content. This section might be particularly informative for those of you under category 2 (and even category 1!).

Chart of resale ECs prices from 2015 to 2022 (Source: EdgeProp)

As you can see, resale ECs have been making good capital gains in recent years which is also reflected in our previous examples of Westwood Residences and Lake Life EC. How is this profit compared to Condo’s though?

Let’s bring back Westwood Residences and Lake Life again, but delve more into its annualised profit this time.

Annualised profit percentage basically reflects the property’s rate of return per year.

Westwood has an annualised return of 6.4% to 2.7%. (Source: Squarefoot Research)

Whilst Lake Life has an annualised yield of 5.2% to 2.7%. (Source: Squarefoot Research)

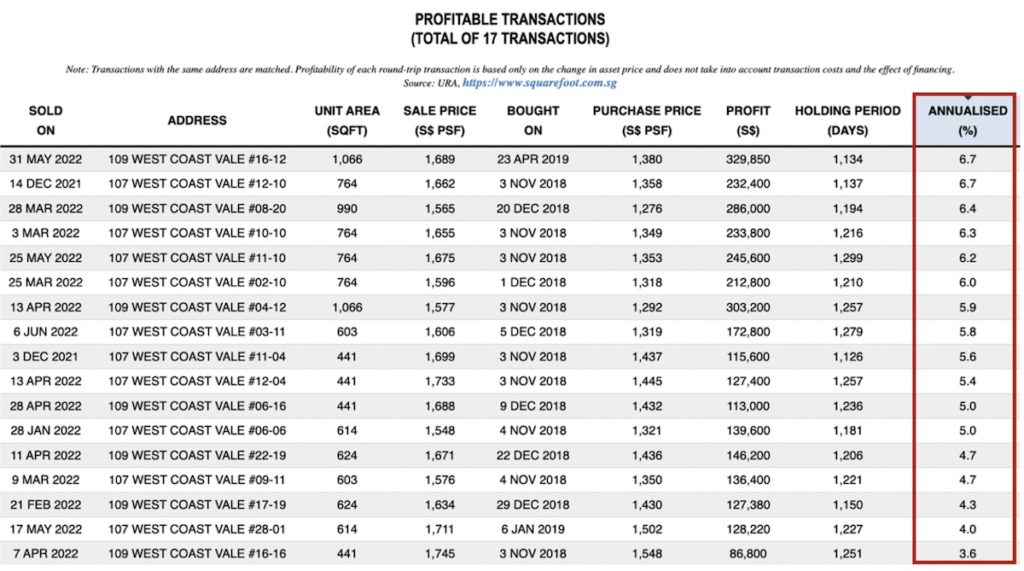

Contrast this to newer condos such as Whistler Grand and Parc Riviera.

Whistler Grand has been making an average of $200,000 profit in a span of roughly 3 years, giving it an annualised yield of 6.7% to 3.6%.

Whistler Grand Annualised (Source: Squarefoot Research)

Meanwhile, Parc Riviera has been making an average of $180,000 profit in a span of 3-4 years, with its annualised yield ranging from 7.9% to 0.8%.

Parc Riviera Annualised (Source: Squarefoot Research)

If you zoom into the second row, the seller was able to make an incredible profit in a mere span of 1 year!

Although ECs might be making a greater or comparable profit to condos, do remember that the estimated time taken for this entire process might be 8-9 years, from the time you collect your keys to eligibility to sell after MOP. To add on, while waiting for the EC’s TOP, you might resort to renting or living with your parents. Renting ultimately eats into your profits and living with your parents basically means a lack of freedom.

On the other hand, factoring in the buying and selling process, the Condo route might take 3-4 years. Furthermore, you can immediately move into your new home.

All these while not forgetting that a larger loan can be taken out for private condos*.

*Home financing is regulated by Total Debt Servicing Ratio (TDSR) for private condos and Mortgage Service Ratio (MSR) applies for ECs. MSR limits monthly payments to 30% of the borrower’s gross monthly income whilst TSDR limits to 60%.

- Whistler Grand Swimming Pool Slide

- Parc Riviera Swimming Pool

Don’t get me wrong. I’m not saying that a condo is the correct and better choice. Ultimately, there are downsides to getting a condo as well (ABSD, unprofitability etc.).

If Your End Goal Is Increasing Your Net Cash, an EC Can Eventually Get You There As Well

If a private condo is currently out of reach, but you will still like to enjoy living in a condo now, an EC is certainly able to increase your net cash too, albeit a longer time.

Let me break it down for you with a hypothetical example.

Given that your current HDB is valued at $450,000, your take back CPF and cash might amount to $350,000 after settling the bank’s outstanding loan when you sell it.

As of now, a 3 Bedroom unit in Tengah Garden Walk EC is estimated to be around $1,2000,000. With this, your take back CPF and cash received from selling your HDB is able to cover the sum needed for the EC’s downpayment and stamp duty ($332600 < $350,000).

3 Bedroom Unit = $1,2000,000

Down Payment = $1,2000,000 x 25% = $300,000

Stamp Duty = $32,600

Total = $300,000 + $32,600 = $332,600 < $350,000

By using Lake Life and Westwood Residences as a benchmark, in 5 years’ time when MOP is over, Tengah Garden Walk EC can have an expected profit of about $250k at a resale price of $1,450,000.

If so, with a $4000 monthly mortgage, after settling all your outstanding bank loans, you can expect a net cash of $700,000. That’s double the cash flow you began with 5 years ago!

Loan = $1,200,000 – $300,000 (down payment) = $900,000

Monthly Interest = $1500

Monthly Principal = $2500

5 Year Principal = $2500 x 60 = $150,000

Outstanding Loan = $900,000 – $150,000 = $750,000

Profit = $1,450,000 – $750,000 = $700,000

With this $700,000, you can either decide to live in a HDB once again or upgrade to a Condo. If you choose the latter, the cash received from selling your EC is easily able to cover the Condo’s downpayment and stamp duty.

Down payment: $1,800,000 x 25% = $450,000

Stamp Duty: $56,600

Total: $450,000 + $56,600 = $506,600 < $700,000

Should you decide to live in a HDB after, the profit you receive from selling the Condo might just be able to ultimately fund your future retirement.

Understand that this portion might be a little tedious to digest. I will be happy to clarify anything you are unsure of and give a consultation specific to your case with no obligation! Just drop me a WhatsApp text/call @ 90074405.

To Conclude…

The topic of EC vs Condo will always be debated on. The property market is rapidly changing and I can’t confidently claim that the safer and less expensive route would be to go for an EC (as evident in North Gaia & Windermere).

Will Tengah Garden Walk EC have similar outcomes to Lake Life and Westwood Residences? Or is a nearby Condo more worth it in its case, given that the EC’s estimated psf is quite expensive. To add on, its location will be considered a “bird no lay egg place” for the upcoming years.

In the end, it all boils down to your specific needs. As much as I have my personal opinion that a Condo is a better choice, that is because I come from a place where I would like to provide my family of 2 kids with a comfortable living space (+ many other factors).

- Whistler Grand

- Parc Riviera

All I can present to you now are facts that might be worth considering. Unsure about whether Tengah Garden Walk EC (or any other EC) would suit you? I would like to hear more about your case and see whether you fall under the same category of “Condo over EC” like me.

Feel free to WhatsApp me directly at +65 9007 4405 for further discussion or if you have any questions to ask.

Lastly, if you fall under the third category of “I just kaypoh…” and have read till here, I’m guessing you must be someone who is really interested in the property market. I love connecting with people of similar interests, so feel free to have a chat with me over your thoughts towards this article (or anything related to property) 😁

Also, I recommend going to our YouTube channel next and ‘kaypoh’ how MDLSG sells properties using digital means 😉.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

If you feel that this article provided good insights on the real estate market, please like it below so that your friends will be able to read this too.