** Update as of 24 June 2019, I heard estimated average prices for Sumang Walk EC will be going at $1150 psf.**

It was the talk of the town in 2018 when this land at Sumang Walk (Piermont Grand EC) was heavily contested by 17 bidders. Eventually, CDL & TID successfully won it with a stunning top bid of S$509.37 million, working out to be a record S$583 psf/pr.

You should be surprised to know that it is also 64 per cent higher than the top bid of S$355 psf/pr for the Anchorvale Lane site in August 2016, which was the last EC tender.

Source: Screen grab from Channel News Asia

I was given the opportunity yesterday to have a first hand preview of the showflat and all I can say is that the luxurious and quality fittings would make upgrading families yearn for this project purchase emotionally.

The smallest 3-bedroom size range from 840-990sqft. These figures will be important for our calculations later on.

But before you decide to book any unit, understand these 5 critical factors that I analysed over the night.

1. Important To Know Your Nearby Selling Competition In Future: Hundred Palms Residences

Remember Hundred Palms Residences EC launch in July 2017 that was fully sold out in just 7 hours? The land was purchased at S$331 psf/pr and sold at an average $836 psf. It was the most over subscribed EC in recent times mainly because it sits in District 19, a very sought after location and is 1km distance to Rosyth School.

Hundred Palms Residences EC, marked by red marker, is with 1KM of highly sought after primary schools.

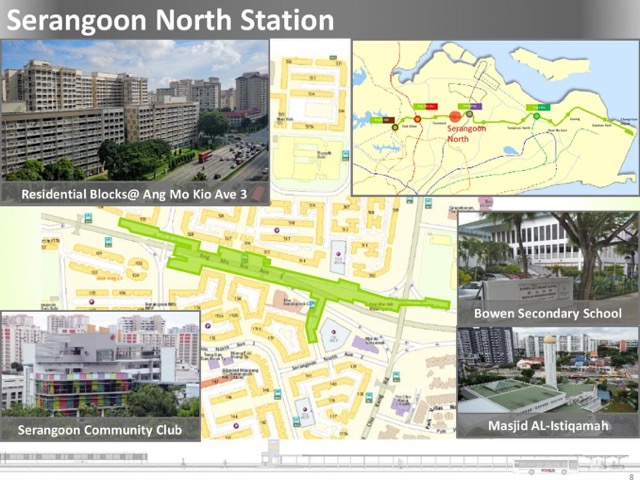

In 2019, Cross Island Line Phase 1 was announced, and Serangoon North Station will be built just 5 minutes walk from Hundred Palms. It could be the next best EC location, after Bishan Loft many years ago, to be released into the resale market in 2025 once the owners sit out their minimum occupation period of 5 years.

Confirmed Serangoon North Station (Source: LTA)

2. Piermont Grand EC’s Launch Price Is Crucial To Your Future Profits.

Well, I do not have the latest release price yet, and when I do, I will write an update here (so bookmark my page yah!) Updated at top of article, average prices will be at $1150 psf.

But, what I do know is that the average cost of construction will be at least $450 psf, before the developer even makes a profit, making the breakeven price for Piermont Grand to be at $1033 psf.

Developments like Affinity At Serangoon and Florence Residences have an average build cost of $450 psf minimally.

Eventually on launch date, we should be expecting launch prices to start from $1133 psf and upwards. Assuming that developers only want $100 psf profits!

With a purchase price at $1133 psf on average, that means you have to sell it later on at $1333 psf after passing MOP.

3. Your Sumang Walk EC Resale Value Could Be Diluted By Hundred Palms

Like every EC after passing their MOP, profit hungry sellers are definite to cash out and upgrade their asset portfolio again. The MOP for Hundred Palms will begin to start in 2025. Where as for Piermont Grand, the expected MOP could be 2027 or 2028.

Let’s take a current MOP-ed EC as a reference.

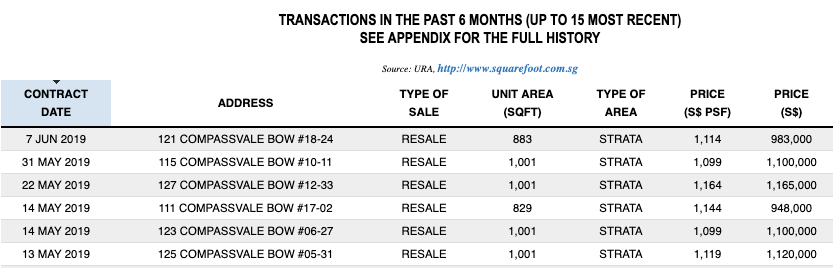

Esparina Residences at Compassvale Bow has recently reached their MOP and sellers there have sold at a profit of between $300-400 psf after a long 9 year wait. (4 years construction timeline + 5 years MOP duration)

Esparina Residences Transactions

Thus, I would assume that Hundred Palms should fetch a minimum of $400 psf profit in the future. We should start seeing resale prices here reaching $1236-1300 psf.

Imagine this, in 2025, several units will be put up for sale in Hundred Palms in the range of $1236 – $1300 psf. And having strong attributes a next door Serangoon North MRT Station to be ready soon, and Rosyth Primary School within 1km in distance, will resale buyers be enticed to buy Piermont Grand in the resale market at $1333 psf, (This is the minimum you should fetch if the purchase price was at $1133 psf) OR buy Hundred Palms at a similar price point?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

4. Any EC Launch Will Always Be Highly Sought After

You are still able to receive up to $30,000 housing grant when you buy a new EC, which spells great news. Who doesn’t love government subsidy?

Available grants (Source: HDB)

I was marketing an Austville Residences unit recently and have met a few buyers, who are also considering to book a unit at Piermont Grand EC. Reasons to book it were mainly due to

- the familiarity of growing up in the Punggol/Sengkang neighbourhood

- their children and siblings are already in nearby primary school

- their grandparents live in nearby HDB Flats and are of great help in caregiving

All these are critical factors when deciding on a next home purchase. I am totally expecting Piermont Grand to be near fully sold on launch date as it is the only EC launch in 2019.

However, before you decide to book a unit at Piermont Grand, do consider these 2 priorities in life.

- Would you be looking to live in this EC for a long period of 10-15 years and this would be your lovely nest together with your children. OR

- Would you be looking to sell at MOP and cash out on the value for a future property upgrade?

Your priorities in future will lead you to making a right investment decision today.

5. EC Prices Edging Close To Private Properties

Minister Khaw has commented in the past on ECs being a good investment and likening EC units to cars. Khaw said that the scheme has given Singaporeans a chance to buy a luxury “Lexus” at (Toyota) “Corolla” prices.

But are you buying an EC today at a Corolla price or Camry price? I would think the latter.

Based on the information I have on hand now, the smallest 3 bedroom unit will be 840-990sqft. Assuming that the lowest launch price is $1133 psf, that translates to an absolute quantum of $951,720 to $1,121,670.

What can you buy at this quantum range?

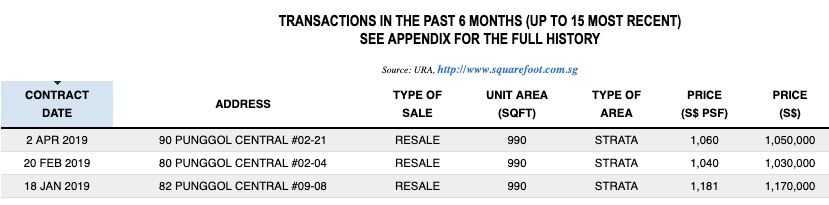

If you don’t mind a resale private property that is walking distance to Punggol MRT Station and bus interchange, you have Parc Centros as an alternative option, and they are not selling at a price too high.

A 3 bedroom, 990sqft on a second floor recently transacted at $1,030,000.

Parc Centros Past Transactions

Also, looking at current new private properties inventory list, with just a little top up on the initial downpayment, you can easily purchase a 3 bedroom in Tampines at $1,002,000 – $1,058,000 or even in Hougang a 2 bedroom + study at $1,002,000 – $1,048,000.

** I thought about 2 extra points over the weekend while digesting over the potential launch price of $1150 psf.

Bonus #6. The Breakeven Price To Sell At. (EC VS Private Property)

Bear in mind that you only need to hold a private property for 3 years from your sales and purchase agreement date compared to a 5 years period for ECs starting from key collection date. (Without factoring in construction build time of 3 – 4 years.)

At the point when you book your EC assuming at $1 million, you would have paid up $24,600 in stamp fees. And over the course of construction, you will be on a progressive payment scheme. A $750,000 loan over 30 years at 2.6% interest rates would result in an annual amount of $19,000 paid in interests.

Multiply that over your next 5 year occupancy, the total costs, or interest paid up would be $95,000. Meaning to say, your total cost after factoring in stamp fees, seller’s commission, interests would easily be $139,600

Versus

A private property that you buy today and sells it off after crossing the 3 years Seller’s Stamp Duty period, the interests incurred during progressive payment stage is just a little. Plus, the awesome thing about owning a private property is that you can sell it off once you collect keys to it, to a next interested party who wants to move in to a brand new condominium.

But when you sell your EC after passing MOP, bear in mind that it is almost new but still 5 years old, with a 5 year old renovation. Which would have a better value?

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

Bonus #7. Your Exit Strategy Is Important

Most ECs home owners will certainly cash out once they reach MOP. Thus, when you sell, your break even cost will most likely be at:

Purchase Price – $1,000,000

Stamp Fees – $24,600

Interest Cost Over 5 Years – $95,000

Seller’s Commission – $20,000

Total: $1,139,600, $1311psf

This is very near to the resale prices potentially over at Hundred Palms or some other private condominium status properties. Ask yourself this, if you are a future buyer, which is a better buy in the long future?

Owning the right property will open up more options for the home owner cum investor to liquidate and upgrade their portfolio at the next opportunity.

Before you make any important moves in your next stage of life, let me assess your current situation and dish out some good advice, so give me a call or WhatsApp at +65 9007 4405, or to simply get a second opinion on what could be the best option you. You may want to submit the form below if you prefer a callback.

Lastly, I recommend going to our YouTube channel next to find out how MDLSG has been helping owners command the selling price they want through the new age method of real estate marketing. 😉.

Our team at MDL provides consultation in these areas and is set on helping you adjust your portfolio for better upgrades and returns.

Click here to WhatsApp us at +65 9007 4405 for any queries or submit the form below if you prefer a callback.

If you feel that this article provided good insights on the real estate market, please like it below so that your friends will be able to read this too.